Parades Commission for Northern Ireland

Annual Report and Financial Statements for the year ended 31 March 2020

Parades Commission for Northern Ireland

Annual Report and Financial Statements for the year ended 31 March 2020

Presented to Parliament pursuant to Schedule 1 paragraphs 12 and 13 of the Public Processions (Northern Ireland) Act 1998

Ordered by The House of Commons to be printed 16th July 2020

© Parades Commission for Northern Ireland copyright 2020

The text of this document (this excludes, where present, the Royal Arms and all departmental or agency logos) may be reproduced free of charge in any format or medium provided that it is reproduced accurately and not in a misleading context.

The material must be acknowledged as Parades Commission for Northern Ireland copyright and the document title specified. Where third party material has been identified, permission from the respective copyright holder must be sought.

Any enquiries related to this publication should be sent to us at Deputy Secretary, Parades Commission for Northern Ireland, Andras House, 60 Great Victoria Street, Belfast, BT2 7BB

This publication is available at https://www.gov.uk/government/publications ISBN 978-1-5286-2065-9

CCS 0320365088

Printed on paper containing 75% recycled fibre content minimum

Printed in the UK by the APS Group on behalf of the Controller of Her Majesty’s Stationery Office

Contents

The 2019 parading season built on the progress of recent years, with improved community relations contributing to positive outcomes across most parading locations. Local accommodations developed and strengthened in North Belfast, Castlederg and other places. There were few protests.

However, there were challenges. The major threat to the stability of parading arose in respect of the ‘Derry Model’, a decades-long parading accommodation agreed by the Apprentice Boys of Derry, local residents, the business community, bands and mediators. The risks to the accommodation in 2019 were managed by a wide range of parties, including individual mediators who worked tirelessly to ensure that the positive work of previous decades was not undone.

While their efforts were ultimately successful, there was a stark realisation of the dangers of complacency about longstanding agreements, and a renewed recognition that peaceful parading requires ongoing dedication and commitment.

A small number of new parades in 2019 also gave rise to complaints. These included a new parade in October in Newry to commemorate the Hunger Strikes, and parades of local lodge banners in East and North Belfast. The Commission imposed conditions in order to manage the risks surrounding these. In addition, the late notification and route of the annual Anti-Internment League parade in Belfast in August gave rise to significant complaints, with the Commission considering it necessary to restrict the parade’s route.

While the fire at Bank Buildings in late 2018 gave rise to concerns about the impact on parades through Belfast city centre, the safety issues for large parades in the area were managed effectively and responsibly by parade organisers, including for the Twelfth of July

Some parades continued to require significant policing operations, including the traditional Somme parade in East Belfast. The Commission continued to encourage dialogue regarding this parade.

The Commission recognises that there will not be a traditional parading season during 2020. The major parading bodies announced early in April 2020 their decisions to cancel parades, with confirmation in early April of the cancellation of the Twelfth of July celebrations.

While the landscape for parades is currently disrupted by the Covid-19 pandemic, the Commission has every reason to believe that parading, when it resumes, will continue to be conducted in a peaceful and collaborative manner.

ANNE HENDERSON

PERFORMANCE REPORT

OVERVIEW

The Parades Commission was established on 27 March 1997, initially as a non- statutory body. The Public Processions (Northern Ireland) Act 1998, amended by the Public Processions (Amendment) Northern Ireland Order 2005, gives the Commission statutory responsibilities in relation to regulating public processions and related protests.

The Parades Commission operates from a single site in Belfast City Centre. Contact details are as follows:

Parades Commission 2nd floor, Andras House 60 Great Victoria Street Belfast

BT2 7BB

Telephone: 028 9089 5900

E-mail info@paradescommissionni.org

Web: www.paradescommission.org

The Commission’s statutory role is set out in the Public Processions (Northern Ireland) Act 1998. Section 2 (1) of that Act provides that:

“It shall be the duty of the Commission –

-

to promote greater understanding by the general public of issues concerning public processions;

-

to promote and facilitate mediation as a means of resolving disputes concerning public processions;

-

to keep itself generally informed as to the conduct of public processions and protest meetings;

-

to keep under review, and make such recommendations as it thinks fit to the Secretary of State concerning, the operation of the Act.”

And Section 2(2) provides that:

“The Commission may in accordance with the provisions of this Act:

-

facilitate mediation between parties to particular disputes concerning proposed public processions and take such other steps as appear to the Commission to be appropriate for resolving disputes; and

-

issue determinations in respect of particular proposed public processions.”

The Commission is currently made up of seven Commissioners, including a Chair. The Commissioners are appointed by the Secretary of State for Northern Ireland. A secretariat supports the Commission in the delivery of its statutory responsibilities as set out in the Act.

The Secretary to the Commission, Lee Hegarty, resigned on 18 March 2020. The Secretary is responsible for the effective operation of the secretariat and for managing its financial and human resources. The position remains vacant at 31 March 2020. The Deputy Secretary to the Commission has been appointed as interim Accounting Officer until the position is filled.

The Secretariat is responsible for providing advice and support to the Chair and Commissioners in support of their aims and objectives, and in undertaking their statutory responsibilities. The Secretariat had an average of 7 staff in post over the year. The Commission also made use of services provided by external professionals such as media services, auditors, mediators and an accountant.

FINANCIAL STATEMENTS

Under paragraph 12 (1) of Schedule 1 to the Public Processions (Northern Ireland) Act 1998, as amended by the Public Processions (Northern Ireland) Act 1998 (Accounts and Audit) Order 1998, the Commission is required to:

-

keep proper accounts and proper records in relation to the accounts; and

-

prepare a statement of accounts in respect of each financial year of the Commission.

The accounts have been prepared in accordance with a direction issued by the Northern Ireland Office (NIO) under the 1998 Act. The accounts incorporate a Statement of Comprehensive Net Expenditure, a Statement of Financial Position, a Statement of Cash Flows, a Statement of Changes in Taxpayers’ Equity and related notes.

GOING CONCERN

The Statement of Financial Position at 31 March 2020 shows net liabilities of

£65,324 (2019: £34,208). In addition, there are lease liabilities committed for future years of £91,546 (2019: £56,912).

The Commission’s sponsoring body is the Northern Ireland Office as laid out in the Public Processions (Northern Ireland) Act 1998. The Commission’s budget for 2020-21 has been approved by the Northern Ireland Office. At the date of this report the accounting officer has no reason to believe that further support beyond 31 March 2021 will not be forthcoming due to the protections laid down in the Public Processions (Northern Ireland) Act 1998. Therefore it has been considered appropriate to adopt a going concern basis for the preparation of the 2019-20 financial statements.

PARADING ACTIVITIES

The current legislation requires that all public processions, with the exception of funerals and Salvation Army organised parades, are notified to the police at least 28 days before the date of the parade. Parade related protests are required to be notified to the police at least 14 days before the date of the parade. These notices are then passed on to the Parades Commission. Notifications can be submitted

manually at a PSNI station or by using the on-line notification function on the website www.paradescommission.org

There was a reduction (436) in the number of notified parades and parade related protests in 2019-20 when compared with the previous year. See Table 1.

Table 1: detailed breakdown of Parades and Parade related protests

|

Parades and Parade related protests

|

2019-20

|

2018-19

|

|

Total notifications received:

|

3,793

|

4,229

|

|

Protestant/Unionist/Loyalist notifications

|

2,312

|

2,523

|

|

Catholic/Republican/Nationalist notifications

|

99

|

107

|

|

“other” notifications*

|

1,382

|

1,599

|

|

|

|

|

|

Total notifications considered sensitive:

|

186

|

183

|

|

Protestant/Unionist/Loyalist sensitive**

|

176

|

177

|

|

Catholic/Republican/Nationalist sensitive

|

3

|

4

|

|

“others”

|

7

|

2

|

|

|

|

|

|

Number of parades or parade related protests with conditions imposed:

|

133

|

135

|

|

Protestant/Unionist/Loyalist sensitive**

|

124

|

129

|

|

Catholic/Republican/Nationalist sensitive

|

2

|

4

|

|

“others”

|

7

|

2

|

*Other category includes charity, civic, rural and sporting events, as well as church parades. Collectively, these made up 36 percent of the overall total number of parades.

**Protestant/Unionist/Loyalist sensitive parades include 52 weekly protest parades in Portadown

Sensitive Parades and Parade Related Protests

Some parades and parade related protests are deemed “sensitive” as they have the potential to raise concerns and community tensions. In making its decisions, the Commission seeks to balance the conflicting rights of different groups within the statutory criteria laid down in the legislation. It approaches all “sensitive parades” independently and fairly

In 2019-20, 133 parades and parade related protests were subject to restrictions (2018-19:135). The type of restrictions placed on parades or parade related protests include the route, size and timing of a parade or parade related protest, type of music to be played, behaviour and dress code. There has been a 1% reduction in the number of parades that have restrictions placed on them when compared with 2018-19.

The Commission’s overall objective is to help bring about a situation in which parades can take place peacefully in an atmosphere of mutual respect.

KEY ISSUES AND RISKS THAT COULD AFFECT THE COMMISSION IN DELIVERY OF ITS OBJECTIVES

The principal risk identified is anything that would prevent the Commission from discharging its statutory duties in respect of notified processions and related protests. The highest ranking risks relate to our infrastructure, including maintenance of IT and protection of information. The global Covid19 pandemic which has resulted in lockdown across the country from 23 March 2020 has resulted in Parades Commission staff implementing business continuity plans with staff being forced to carry out their duties from home. This has worked very successfully with staff and Commissioners being able to fulfil their statutory duties in this manner. There has been no detrimental effects on the financial position of the Commission as all staff have remained gainfully employed by the Commission with no need for staff redeployment or increased sickness absence. As we have no income streams there was no loss to the Commission. The timing of pandemic coincided with the start of our busy period for parade notifications and we have seen a reduction in the number of parades notified but not a complete cessation as organisers continue to notify for parades in the future, once lockdown restrictions have been eased or removed. The ‘Approach to Decision-Making’ document published by the NI Executive on 12th May 2020 does not make any specific reference to parades which presents the risk of various interpretations by different groups as to when parades may safely recommence. The Commission continues to seek clarity on this matter.

Within the executive processes of the Parades Commission, there is embedded a corporate risk register in line with Government guidance. Risks are identified, assessed in terms of likelihood and impact, and then ranked in terms of priority.

The risk register is kept under constant review and updated as necessary. Management consider signs or warnings of risks altering, examine existing controls to reduce or manage risks and, if necessary, take additional action.

PERFORMANCE ANALYSIS

The table below summarises performance against Parades Commission 2019-20 business plan targets. Each target outcome is listed in detail below the table.

|

|

Business Plan Objective

|

Total Number of Target Outcomes

|

Number of Target Outcomes – Fully Achieved

|

Number of Target Outcomes – Substantially Achieved

|

Number of Target Outcomes – Not Achieved

|

|

1

|

To consider particular proposed parades and to issue determinations as deemed necessary

|

3

|

3

|

|

|

|

2

|

To promote greater understanding by the general public of parading issues

|

2

|

2

|

|

|

|

3

|

To keep itself generally informed on the conduct of public processions and protest meetings

|

4

|

4

|

|

|

|

4

|

To promote and facilitate mediation as a means of resolving disputes concerning public processions

|

1

|

1

|

|

|

|

5

|

To maintain high standards of governance & ensure value for money is achieved

|

3

|

3

|

|

|

ANALYSIS AND EXPLANATIONS REGARDING DEVELOPMENT AND PERFORMANCE

BUSINESS PLAN OBJECTIVE 1 - To consider particular proposed parades and to issue determinations as deemed necessary

Target:

-

To hold formal Commission meetings throughout the year as required for full consideration of 200 approx. sensitive parades/parade related protests.

-

To utilise, to its fullest extent, the Commission’s information database to inform decision making.

-

To issue determinations as deemed necessary in a timely manner.

BUSINESS PLAN OBJECTIVE 2 - To promote greater understanding by the general public of parading issues

Target:

-

To provide context to Commission determinations.

-

By 31 March 2020 to hold outreach meetings at locations across Northern Ireland:

-

During 2019-20, outreach meetings were held in locations across Northern Ireland, with a range of stakeholders. The objective of the meetings was to promote greater understanding of parading issues. The meetings were well attended. Achieved

BUSINESS PLAN OBJECTIVE 3 - To keep itself generally informed on the conduct of public processions and protest meetings

Target:

-

To engage proactively with parade and protest organisers, elected and community representatives, and other stakeholders:

-

To obtain observer reports on the conduct of identified parades;

-

To monitor media reports and statements relating to processions and protest meetings and attend relevant events.

-

To keep under review the operation of the relevant legislation and Commissions procedures.

BUSINESS PLAN OBJECTIVE 4 - To promote and facilitate mediation as a means of resolving disputes concerning public processions

Target:

1. Throughout the year, to explore mediation in areas where local agreement has not been reached, to ensure that the parties are made aware of the benefits of dialogue and to enable mediation where the parties agree to it.

o The Commission identified and supported mediation in a number of parading areas. Achieved

BUSINESS PLAN OBJECTIVE 5 - To maintain high standards of governance & ensure value for money is achieved

Target:

-

To promote the highest standards of corporate governance by defining and strengthening the key relationships amongst the Accounting Officer, the Audit Committee, the Commission and the sponsoring department.

o The Secretary met with the sponsor department on three occasions in 2019/20 and provided Stewardship Statements on the activities of the Commission in line with best practice. The Secretary’s report to the Commission is a standing agenda item at Commission meetings. The Audit Committee met four times in 2019/20. Achieved

-

To maintain an administrative support service to the Commission which is efficient, effective and economical within budget allocation. Achieved

-

To maintain high standards of information and data management in line with legislative requirements. Achieved

SUSTAINABILITY REPORT

A full sustainable development report is not produced as the Parades Commission’s staff complement is below the (250 employees) threshold.

The Commission has a recycling policy that involves the recycling of dry office waste, recycling of print cartridges and the ordering of recycled photocopying paper.

The Secretariat has developed an action plan to reduce the reliance on paper within the office practices.

From March 2015, parade and protest organisers are able to notify parades and parade related protests on-line, reducing use of paper. The number of on-line notifications in 2019-20 has remained static at 55 per cent of total notifications.

N Higgins

Deputy Secretary and

Interim Accounting Officer 08 July 2020

ACCOUNTABILITY REPORT

Background

The Parades Commission for Northern Ireland is a non-departmental public body sponsored by the Northern Ireland Office. Created on 27 March 1997, its statutory responsibilities are set out in the Public Processions (Northern Ireland) Act 1998, amended by the Public Processions (Amendment) Northern Ireland Order 2005.

The Budget for the Commission is set by the Secretary of State for Northern Ireland and the financial activities form part of the NIO Resource Departmental Expenditure Limits (DEL) and Capital DEL estimates. In 2019-20, the Commission was allocated a budget of £788k.

The Directors of the Commission comprise the Secretary and the Commissioners.

The Secretary to the Commission, Lee Hegarty, resigned on 18 March 2020. The post currently remains vacant and the recruitment process is ongoing. As a result of this vacancy the Deputy Secretary to the Commission has been appointed as interim Accounting Officer.

ROLE OF THE CHAIR OF THE PARADES COMMISSION

The Chair is required to attend and chair Commission meetings, ensuring that these meetings are at appropriate intervals. The Chair must develop policy and provide strategic direction to the Commission to enable the effective and efficient performance of its statutory duties. The Chair must ensure personal and corporate compliance with the Code of Practice for Members of the Commission. The Chair must accept corporate responsibility for ensuring that the Commission complies with any statutory or administrative requirements for its use of public resources (including the promotion of regularity, propriety and value for money). The Chair shall assess the effectiveness and performance of the individual members of the Commission and report those assessments to the NIO.

COMMISSION MEMBERS

Members are appointed by the NIO. The term of appointment for the original appointments1 was initially three years but was extended in December 2016 until December 2019, this was extended for one further year until December 2020. From 1 April 2019 until 31 March 2020, membership of the Commission was as follows:

Mrs Anne Henderson (Chair)

1 Original Commission appointments made 1st January2014. Anne Marshall was re-appointed 27 March 2018 for a three year period. Geraldine McGahey was appointed 22 February 2016 to 31 December 2016 in line with the original appointment period of the Commission. Joelle Black was appointed 28 May 2018.

Ms Sarah Havlin Mr Paul Hutchinson Mr Colin Kennedy Ms Anne Marshall

Mrs Geraldine McGahey Ms Joelle Black

ANNE HENDERSON

Anne qualified as a chartered accountant in 1988. She worked for the accountancy firms KPMG and BDO Stoy Hayward in Belfast. During her three years in the international audit division of Time Warner Inc., she was based in New York and London and travelled extensively within the USA and across Europe. She has held a number of public appointments including as vice-chair, and briefly chair, of the Northern Ireland Housing Executive. She is a former board member of the International Fund for Ireland and the Enterprise Equity companies.

SARAH HAVLIN

Sarah is a qualified and experienced solicitor and legal adviser. After a career in private practice she now specialises in judicial decision making and regulation. She is currently Certification Officer of Northern Ireland, a quasi-judicial and regulatory role in the field of industrial relations. She has a particular expertise in government and public policy in Northern Ireland and was awarded a professional certificate in Policy Development from the Irish Institute of Boston College and also holds a professional certificate in Regulation from the London School of Economics and Political Science. Sarah has held a number of other positions in public office, judicial decision-making, formal arbitration proceedings and regulatory affairs. She played a significant role in the review of administrative electoral boundaries in Northern Ireland, having previously served as an Assistant Local Government Boundaries Commissioner, Assistant District Electoral Areas Commissioner and currently as Parliamentary Boundary Commissioner for Northern Ireland.

COLIN KENNEDY

Colin is Chief Executive of 'Jordan's Gift' (a NI Charity assisting young people living with disability). Prior to taking up his current position he has been Chief Executive of the Mary Peters Trust and Chief Executive of Lenken Healthcare (Ireland) Ltd. He also spent 14 years in the finance industry. He is currently a member of the Mental Health Review Tribunal for Northern Ireland; a member of the Scrutiny Committee of the Pharmaceutical Society of Northern Ireland and a Director of the Northern Ireland Football League. He was a member of the Nursing and Midwifery Council Fitness to Practice Panel from 2009 to 2017 and served as Chairman of the General Dental Council Complaints Panel from 2006 to 2009 and as Northern Ireland representative on the NHS Pay Review Board from 2013 to 2015.

PAUL HUTCHINSON

Paul is the founder / director of Imagined Spaces, a company exploring creative community relations. A former Centre Director of Corrymeela (2009-14), Paul has a background in mental health, advocacy, mediation and the Arts. He worked for

12 years with NI Association for Mental Health, as a manager, advocate, practitioner / therapist, researcher. He was Associate Lecturer at the University of Ulster from 1999-2002, teaching Advocacy and Empowerment skills. He was a Neighbourhood Renewal Advisor in North West England for 5 years, and worked for 7 years in community cohesion projects in Oldham, Burnley and Blackburn. Paul also has a background in various artistic fields as a documentary film-maker, writer and photographer. Paul is currently Visiting Professor at Dalhousie School of Law, Nova Scotia. His latest book is ‘Between the Bells- Stories of reconciliation from Corrymeela’ (2019 - Canterbury Press).

ANNE MARSHALL

Anne qualified as a solicitor in 1998 and worked in private practice for 12 years specialising in criminal law and human rights work. She has also worked in the Children’s Law Centre and as a prosecutor in the Public Prosecution Service. She was appointed as a Deputy District Judge in 2013 and sits in Criminal, Youth and Family Courts. She currently holds public appointments as Chair of the Exceptional Circumstances Body, Presiding Member of Civil Legal Services Appeals Panel and Chair of Police Appeals Tribunals and also sits as a President of the Review Tribunal. Anne is also a governor in a local primary school.

GERALDINE MCGAHEY

Geraldine McGahey stood down as Chief Executive of Larne Borough Council on 1 April 2015 when the new Northern Ireland district councils were formed. During her time as Chief Executive she was SOLACE’s gender champion promoting women in local government, a representative on the Good Relations Panel reporting to the Office of the First and Deputy First Ministers and an appointee of the First Minister and Deputy First Minister to the Northern Zone Steering Committee for the Social Investment Fund. Previously, Mrs McGahey was a Building Control Surveyor in Belfast City Council (1993-2001) and Grants Officer with the Northern Ireland Housing Executive (1983-1989). She received an OBE for services to local government in the New Year Honours list for 2015. Mrs McGahey currently is the Chief Commissioner of the Equality Commission for Northern Ireland and a non-executive director for the Northern Health and Social Care Trust. She is also a mentor to the Woman’s Leadership Initiative.

JOELLE BLACK

Joelle was appointed to the Commission in May 2018. Joelle is a Barrister-at-law and has been a Principal Public Prosecutor with the Public Prosecution Service for Northern Ireland since 2008. During this period, Joelle was seconded by the Foreign and Commonwealth Office to EULEX Kosovo as a Special Prosecutor.

REGISTER OF INTERESTS

Commission members and senior secretariat staff are required to provide information of personal or business interests that might be perceived by a reasonable member of the public to influence their judgement in the exercise of their public duty. The Parades Commission maintains a register of interests which is available for public inspection. No interests were declared which may be perceived to conflict with their regulatory role or management responsibilities.

PERSONAL DATA RELATED INCIDENTS

There were no personal data related incidents formally reported to the Information Commissioner’s Office.

REMUNERATION AND STAFF REPORT

REMUNERATION POLICY

The remuneration of the Chair and Commissioners is determined by the Secretary of State for Northern Ireland.

The Parades Commission does not directly employ staff, it seconds staff from the Home Civil Service (HCS), the Northern Ireland Civil Service (NICS) or via the interchange scheme.

For senior civil servants seconded from HCS, the remuneration is set by the Prime Minister, following independent advice from the Review Body on Senior Salaries. In reaching its recommendations, the Review Body has regard to the following considerations:

-

the need to recruit, retain and motivate suitably able and qualified people to exercise their responsibilities;

-

regional/local variations in labour markets and their effects on the recruitment and retention of staff;

-

Government policies for improving the public services, including the requirement on departments to meet the output targets for the delivery of departmental services;

-

the funds available to departments as set out in the Government’s departmental expenditure limits; and

-

Government’s inflation target.

For senior civil servants seconded from NICS, the remuneration is set by the Minister for Finance and Personnel following independent advice from the Review Body on Senior Salaries.

Further information about the work of the Review Body can be found at

www.ome.uk.com.

The remuneration of all senior civil servants is entirely performance-related. Performance is appraised by line managers in respect of achievement of agreed objectives.

SERVICE CONTRACTS

The Constitutional Reform and Governance Act 2010 requires HCS appointments to be made on merit on the basis of fair and open competition. The Recruitment Principles published by the Civil Service Commission specify the circumstances when appointments may be made or otherwise. Unless otherwise stated below, the officials covered by this report hold appointments which are open-ended. Further information about the Civil Service Commissioners can be found at www.civilservicecommission.org.uk

NICS appointments are made in accordance with the Civil Service Commissioners for Northern Ireland’s Recruitment Code, which requires appointment to be on merit on the basis of fair and open competition but also includes the circumstances when appointments may otherwise be made. Unless otherwise stated below, the officials covered by this report hold appointments which are open-ended. Policy relating to notice periods and termination payments is contained in the NICS Staff Handbook. Further information about the Civil Service Commissioners can be found at www.nicscommissioners.org

Details of salaries and allowances paid, benefits in kind and accrued pension entitlement are shown below.

COMMISSIONERS’ NUMBERS AND COSTS (AUDITED)

The total emoluments of the Commissioners (including the Chair) during the year ended 31 March 2020 amounted to £199,692 (2018-19: £196,156) and the expenses incurred by the Commissioners were £380 (2018-19: £326). Both the Chair and Commissioners are non-Northern Ireland Civil Service, therefore they are not pensionable. The salary entitlement of the Chair and Commissioners for 2019-20 was as follows:

|

Commission Member

|

2019-20

|

2018-19

|

|

|

Salary Range

£000

|

Benefits in Kind (to nearest

£100)

|

Salary Range

£000

|

Benefits in Kind (to nearest

£100)

|

|

Anne Henderson (Chair)

|

50-55

|

-

|

50-55

|

-

|

|

Sarah Havlin

|

20-25

|

-

|

20-25

|

-

|

|

Colin Kennedy

|

20-25

|

-

|

20-25

|

-

|

|

Paul Hutchinson

|

20-25

|

-

|

20-25

|

-

|

|

Anne Marshall

|

20-25

|

-

|

20-25

|

-

|

|

Geraldine McGahey

|

20-25

|

-

|

20-25

|

-

|

|

Joelle Black

|

20-25

|

-

|

15-20

|

-

|

This Commission was initially appointed for a 3-year period ending December 2016 and extended for a further 3-year period ending 31 December 2019. The NIO has further extended the appointment of this Commission for a further 1-year period ending December 2020. Commissioner Marshall, who was originally appointed mid-term of the current Commission, was separately re-appointed for 3 years ending 31 March 2021. Commissioner Black was appointed on 28 May 2018 for a 3 year period.

The Commissioners are expected to devote approximately two days per week to Commission business over the course of a year, with a proportionately greater commitment required during the summer months.

REMUNERATION (INCLUDING SALARY) AND PENSION ENTITLEMENTS 2019-20 - AUDITED

|

Single total figure of remuneration

|

|

Officials

|

Salary (£’000)

|

Performance Pay or Bonus

payments (£’000)

|

Non-Cash Benefits (to nearest

£100)

|

Pension Benefits (to nearest £’000)**

|

Total (£’000)

|

|

|

2019

-20

|

2018

-19

|

2019

-20

|

2018

-19

|

2019

-20

|

2018

-19

|

2019-

20

|

2018-

19

|

2019

-20

|

2018

-19

|

|

Lee Hegarty*

|

65-

70

|

65-

70

|

-

|

0-5

|

-

|

-

|

29,000

|

68,000

|

95-

100

|

135-

140

|

|

Nuala Higgins**

*

|

0-5

|

-

|

-

|

-

|

-

|

-

|

1,000

|

-

|

0-5

|

-

|

* Lee Hegarty resigned on 18 March 2020. His full-time equivalent salary for 2019- 20 was £65,000 to £70,000.

** The value of pension benefits accrued during the year is calculated as (the real increase in pension multiplied by 20) plus (the real increase in any lump sum) less (the contributions made by the individual). The real increases exclude increases due to inflation or any increase or decreases due to a transfer of pension rights.

*** Nuala Higgins was appointed as interim Accounting Officer on 24 March 2020. Her full-time equivalent salary for 2019-20 was £40,000 to £45,000.

No bonus payments were paid in 2019-20, (2018-19: £1,580).

Total remuneration includes salary, non-consolidated performance-related pay, benefits-in-kind as well as severance payments. It does not include employer pension contributions and the cash equivalent transfer value of pensions.

SALARY

This report is based on accrued payments made by the Commission and thus recorded in these accounts. “Salary” includes gross salary; overtime; recruitment and retention allowances; private office allowances and any other allowances to the extent that it is subject to UK taxation.

BENEFITS IN KIND

The monetary value of benefits in kind covers any benefits provided by the Parades Commission and treated by HM Revenue and Customs as a taxable emolument. There were no benefits-in-kind in 2019-20.

BONUSES

Bonuses are based on performance levels attained and are made as part of the appraisal process. Bonuses relate to the performance in the year in which they become payable to the individual. The bonuses reported in 2018-19 relate to performance in 2017-18.

PENSION ENTITLEMENTS

Mr Lee Hegarty resigned as Secretary and Accounting Officer with effect from 18 March 2020.

|

Pension Entitlements

|

|

|

Real increase in pension at pension age and lump sum at

31/3/20

|

Total accrued pension at pension age at 31/03/20 and related lump sum

|

Cash Equivalent Transfer Value at 31/03/20

|

Cash Equivalent Transfer Value at 31/03/19

|

Real increase in CETV

|

|

|

£000

|

£000

|

£000

|

£000

|

£000

|

|

Lee Hegarty

|

0-2.5

plus nil

|

15 -20 plus nil

|

237

|

211

|

12

|

|

Nuala Higgins

|

0-2.5 plus nil

|

10-15 plus nil

|

206

|

205

|

1

|

PENSION ARRANGEMENTS

Pension benefits are provided through the Civil Service pension arrangements. From 1 April 2015 a new pension scheme for civil servants was introduced - the Civil Servants and Others Pension Scheme or alpha, which provides benefits on a career average basis with a normal pension age equal to the member’s State Pension Age (or 65 if higher). From that date all newly appointed civil servants and the majority of those already in service joined alpha. Prior to that date, civil servants participated in the Principal Civil Service Pension Scheme (PCSPS). The PCSPS has four sections: 3 providing benefits on a final salary basis (classic, premium or classic plus) with a normal pension age of 60; and one providing benefits on a whole career basis (nuvos) with a normal pension age of 65.

These statutory arrangements are unfunded with the cost of benefits met by monies voted by Parliament each year. Pensions payable under classic, premium, classic plus, nuvos and alpha are increased annually in line with Pensions Increase legislation. Existing members of the PCSPS who were within 10 years of their normal pension age on 1 April 2012 remained in the PCSP after 1 April 2015. Those who were between 10 years and 13 years and 5 months from their normal pension age on 1 April 2012 will switch into alpha sometime between 1 June 2015 and 1 February 2022. All members who switch to alpha have their PCSPS benefits ‘banked’, with those earlier benefits in one of the final salary sections of the PCSPS having those benefits based on their final salary when they leave alpha. (The pension figures quoted for officials show pension earned in PCSPS or alpha – as appropriate. Where the official has benefits in both the PCSPS and alpha the figure quoted is the combined value of their benefits in the two schemes.) Members joining from October 2002 may opt for either the appropriate defined benefit arrangement or a ‘money purchase’ stakeholder pension with an employer contribution (partnership pension account).

Employee contributions are salary related and range between 4.6% and 8.05% for members of classic, premium, classic plus, nuvos and alpha. Benefits in classic accrue at the rate of 1/80th of final pensionable earnings for each year of service. In addition, a lump sum equivalent to three years initial pension is payable on retirement. For premium, benefits accrue at the rate of 1/60th of final pensionable earnings for each year of service. Unlike classic, there is no automatic lump sum. Classic plus is essentially a hybrid with benefits for service before 1 October 2002 calculated broadly as per classic and benefits for service from October 2002 worked out as in premium. In nuvos a member builds up a pension based on his pensionable earnings during their period of scheme membership. At the end of the scheme year (31 March) the member’s earned pension account is credited with 2.3% of their pensionable earnings in that scheme year and the accrued pension is uprated in line with Pensions Increase legislation. Benefits in alpha buiId up in a similar way to nuvos, except that the accrual rate is 2.32%. In all cases members may opt to give up (commute) pension for a lump sum up to the limits set by the Finance Act 2004.

The partnership pension account is a stakeholder pension arrangement. The employer makes a basic contribution of between 8% and 14.75% (depending on the age of the member) into a stakeholder pension product chosen by the employee from a panel of providers. The employee does not have to contribute, but where they do make contributions, the employer will match these up to a limit of 3% of pensionable salary (in addition to the employer’s basic contribution). Employers also contribute a further 0.5% of pensionable salary to cover the cost of centrally-provided risk benefit cover (death in service and ill health retirement).

The accrued pension quoted is the pension the member is entitled to receive when they reach pension age, or immediately on ceasing to be an active member of the scheme if they are already at or over pension age. Pension age is 60 for members of classic, premium and classic plus and 65 for members of nuvos, and the

higher of 65 or State Pension Age for members of alpha. (The pension figures quoted for officials show pension earned in PCSPS or alpha – as appropriate. Where the official has benefits in both the PCSPS and alpha the figure quoted is the combined value of their benefits in the two schemes, but note that part of that pension may be payable from different ages.

Further details about the Civil Service pension arrangements can be found at http://www.civilservicepensionscheme.org.uk

Cash Equivalent Transfer Values

A Cash Equivalent Transfer Value (CETV) is the actuarially assessed capitalised value of the pension scheme benefits accrued by a member at a particular point in time. The benefits valued are the member’s accrued benefits and any contingent spouse’s pension payable from the scheme. A CETV is a payment made by a pension scheme or arrangement to secure pension benefits in another pension scheme or arrangement when the member leaves a scheme and chooses to transfer the benefits accrued in their former scheme. The pension figures shown relate to the benefits that the individual has accrued as a consequence of their total membership of the pension scheme, not just their service in a senior capacity to which disclosure applies.

The figures include the value of any pension benefit in another scheme or arrangement which the member has transferred to the Civil Service pension arrangements. They also include any additional pension benefit accrued to the member as a result of their buying additional pension benefits at their own cost. CETVs are worked out in accordance with The Occupational Pension Schemes (Transfer Values) (Amendment) Regulations 2008 and do not take account of any actual or potential reduction to benefits resulting from Lifetime Allowance Tax which may be due when pension benefits are taken.

Real increase in CETV

This reflects the increase in CETV that is funded by the employer. It does not include the increase in accrued pension due to inflation, contributions paid by the employee (including the value of any benefits transferred from another pension scheme or arrangement) and uses common market valuation factors for the start and end of the period.

COMPENSATION FOR LOSS OF OFFICE (Audited)

There were no redundancy or departure costs paid or payable by the Parades Commission in 2019-20 or 2018-19 in respect of Civil Service or other compensation schemes.

PAYMENTS TO PAST DIRECTORS (Audited)

No payments have been made to any person who was not a Director at the time the payment was made, but who had been a Director previously.

FAIR PAY DISCLOSURE (Audited)

The Commission is required to disclose the relationship between the remuneration of the most highly-paid Director, as disclosed in the remuneration table on page 20, in the organisation and the median remuneration of the organisation’s workforce.

|

|

2019-20

|

2018-19

|

|

Salary

|

Salary

|

|

Band of Highest Paid Director's / Commissioner’s FTE Total Remuneration

|

£000

65-70

|

£000

65-70

|

|

Median Total Remuneration

|

£25,491

|

£27,899

|

|

Ratio

|

2.65

|

2.42

|

The highest paid Director in the Parades Commission in the financial year 2019- 20 was paid in the band £65,000 - £70,000 FTE (2018-19 was £65,000 -

£70,000). Payments to Commissioners are excluded from the fair pay calculations. In 2019-20, the salary of the highest paid Director, was 2.65 times (2018-19: 2.42 times) the median remuneration of the workforce, which was

£25,491 (2018-19: £27,899).

Remuneration ranged from £20,787 to £67,555 (2018-19: £22,740 to £69,851).

The calculations exclude the remuneration to the Commissioners as their employment terms and conditions, including rates of remuneration, are determined by the United Kingdom Government, and the Parades Commission for Northern Ireland is unable to influence those rates. Details of their remuneration are provided above.

STAFF REPORT (Audited)

Number of Senior Civil Service Staff

|

Grade of Senior Civil Servant

|

2019-20

Number of Staff

|

2018-19

Number of Staff

|

|

5

|

1

|

1

|

The average number of whole-time equivalent persons engaged during the year was as follows:

|

|

2019-20

|

2018-19

|

|

Total

|

Commissioners* and Seconded Staff

|

Agency Staff

|

Total

|

|

Directly engaged

|

7

|

7

|

-

|

7

|

|

Other

|

8

|

8

|

-

|

7

|

|

Total

|

15

|

15

|

-

|

14

|

* The Commissioners are expected to devote approximately two days per week to Commission business over the course of a year, with a proportionately greater commitment required during the summer months. Each commissioner is included as one whole-time equivalent person in the above numbers.

|

|

2019-20

|

2018-19

|

|

|

Total

|

Seconded staff

|

Total

|

|

|

£

|

£

|

£

|

|

Wages and Salaries

|

455,713

|

455,713

|

428,863

|

|

Social security costs

|

46,948

|

46,948

|

42,321

|

|

Other pension costs

|

71,068

|

71,068

|

49,390

|

|

Total net costs

|

573,729

|

573,729

|

520,574

|

Staff Composition

|

|

2019-20

|

2018-19

|

|

Total Average Number of Persons Engaged

|

Average Number of Female Persons Engaged

|

Average Number of Male Persons Engaged

|

Total Average Number of Persons Engaged

|

Average Number of Female Persons Engaged

|

Average Number of Male Persons Engaged

|

|

Commissioners

|

7

|

5

|

2

|

7

|

5

|

2

|

|

Senior Civil

|

1

|

0

|

1

|

1

|

0

|

1

|

|

Service

|

|

Secretariat Staff

|

7

|

6

|

1

|

6

|

6

|

0

|

|

Total

|

15

|

11

|

4

|

14

|

11

|

3

|

Managing Attendance

The Parades Commission is comprised of seconded civil servants and manages attendance in line with the policies of secondees’ parent departments. Staff absence arising as a result of illness, including injuries, disability or other health problems, was approximately 5 days per employee in 2019-20 (2018-19: 2.1 days).

Disabled Employees

The Parades Commission aims to ensure that there is no discrimination on the grounds of disability and that access to employment and career advancement in the Commission is based solely on ability, qualifications and suitability for the post. The Commission complies with all existing legislation in regard to its disabled employees.

Equal Opportunities

In keeping with the NIO Equal Opportunities Policy Statement, everyone in the Parades Commission has the right of opportunity and to a good and harmonious working environment and atmosphere in which all staff are encouraged to apply their diverse talents and in which no member of staff feels under threat or intimidation.

Employee Involvement

The maintenance of a highly skilled workforce is key to the future of the business. The Parades Commission is committed to and complies with the policies of equal opportunity and responsibility for employee and career development of all staff.

The Parades Commission recognises the benefits of keeping employees informed of the progress of the business and of involving them in the Commissions performance. During the year the employees were regularly provided with information regarding the financial and economic factors affecting the performance

of the Commission and on other matters of concern to them, as employees, through notices and regular staff meetings.

Health & Safety

The Parades Commission recognises its legal responsibilities in relation to the health and safety of its staff and is committed to operating an effective health and safety regime. In line with this commitment the Commission has complied with the relevant legislation.

Expenditure on Consultancy

There was no expenditure on consultancy in 2019-20 (2018-19: £nil).

Off-payroll engagements

There were no off-payroll engagements in 2019-20 (2018-19: £nil).

Exit packages (Audited)

There were no exit packages in 2019-20 (2018-19: £nil).

Under paragraph 12(1) and para (2) of Schedule 1 to the Public Processions (Northern Ireland) Act 1998, the Secretary of State (with the consent of HM Treasury and Northern Ireland Office) has directed the Parades Commission for Northern Ireland to prepare for each financial year, a statement of accounts in the form and on the basis set out in the Accounts Direction. The accounts are prepared on an accruals basis and must give a true and fair view of the state of affairs of the Parades Commission for Northern Ireland and of its comprehensive net expenditure, statement of financial position, changes in taxpayers’ equity and cash flows for the financial year.

In preparing the accounts, the Accounting Officer is required to comply with the requirements of the Government Financial Reporting Manual and in particular to:

-

observe the Accounts Direction issued by the Northern Ireland Office on behalf of the Secretary of State, including the relevant accounting and disclosure requirements, and apply suitable accounting policies on a consistent basis;

-

make judgements and estimates on a reasonable basis;

-

state whether applicable accounting standards as set out in the Government Financial Reporting Manual have been followed, and disclose and explain any material departures in the financial statements;

-

prepare the financial statements on a going concern basis; and

-

confirm that the annual report and accounts as a whole is fair, balanced and understandable and take personal responsibility for the annual report and accounts and the judgments required for determining that it is fair, balanced and understandable.

The Accounting Officer of the Northern Ireland Office has designated the Deputy Secretary as the interim Accounting Officer for the Parades Commission for Northern Ireland. The responsibilities of an Accounting Officer, including responsibility for the propriety and regularity of the public finances for which the Accounting Officer is answerable, for keeping proper records and for safeguarding the Parades Commission for Northern Ireland’s assets, are set out in Managing Public Money published by the HM Treasury.

As the interim Accounting Officer, I have taken all the steps that I ought to have taken to make myself aware of any relevant audit information and to establish that the Parades Commission for Northern Ireland’s auditors are aware of that information. So far as I am aware, there is no relevant audit information of which the auditors are unaware. I confirm that the Annual Reports and Accounts as a whole is fair, balanced and understandable. I take personal responsibility for the Annual Report and Accounts and the judgements required for determining that it is fair, balanced and understandable.

The Parades Commission for Northern Ireland (the Commission) is an independent executive non-departmental public body sponsored by the Northern Ireland Office (NIO) which was created on 27 March 1997. It was given statutory responsibilities on 16 February 1998 by the commencement of the Public Processions (Northern Ireland) Act 1998.

The Commission currently has seven Commissioners, including its Chair. It is supported by a secretariat. The secretariat had on average seven seconded staff, including myself, all seconded to the Commission from public sector bodies The position of Secretary became vacant towards the end of the reporting period and I, in my role as Deputy Secretary, was appointed as interim Accounting Officer with effect 25 March 2020. A new Secretary is expected to be appointed in the next reporting period. The previous Accounting Officer provided formal interim assurance at 30 September 2019, that there were no significant internal control issues to note. I have been in post as Deputy Secretary for the whole of the reporting period and am content that there were no issues to note in the intervening period before my appointment as Accounting Officer.

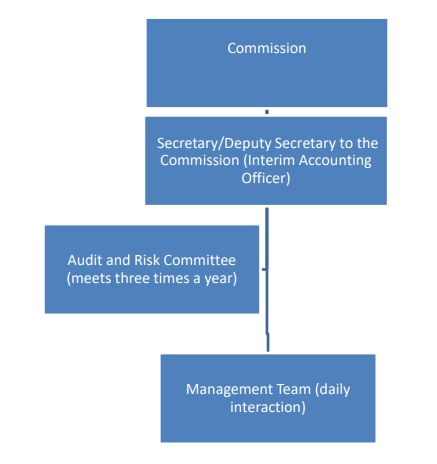

The Commission normally meets on a weekly basis and has a collective responsibility for approving any significant changes relating to the operation or use of resources of the Parades Commission. The Commission also has an Audit and Risk Committee which meets formally three times a year, or more frequently as required, to assist and advise the Accounting Officer on governance responsibilities. Any recommendations made by the Audit and Risk Committee must be approved by the Commission.

As interim Accounting Officer, I regularly discuss operational performance and corporate issues with the sponsor group within the NIO.

Scope of Responsibility

As interim Accounting Officer, I have responsibility for maintaining a sound system of internal governance that supports the achievement of the Commission’s policies, aims and objectives, whilst safeguarding the public funds and assets for which I am personally responsible, in accordance with the responsibilities assigned to me in Managing Public Money. As such, I am responsible for ensuring propriety and regularity in the handling of those public funds; and for the day-to-day operations and management of the Commission.

I am also responsible for the effective operation of the secretariat and for managing its financial and human resources. I provide advice and support to the Chair and Commissioners in support of their aims and objectives and in undertaking their

statutory responsibilities. One of the statutory responsibilities of the Commission is “to keep under review, and make such recommendations as it thinks fit to the Secretary of State, concerning, the operation of the Act”. There were no recommendations made to the Secretary of State for Northern Ireland in 2019-20. There were no Ministerial directions in the 2019-20 financial year.

Governance Framework

In my role as interim Accounting Officer, I discharge my responsibilities with the support of the Audit and Risk Committee and my Management Team. This is outlined below:

The statutory duties of the Commission include:

-

promoting greater understanding by the general public of issues concerning public processions;

-

promoting and facilitating mediation as a means of resolving disputes concerning public processions;

-

keeping itself generally informed as to the conduct of public processions and protest meetings; and

-

keeping under review, and making such recommendations as it thinks fit to the Secretary of State concerning, the operation of the Act.

Throughout 2019-20, the Commission effectively discharged its statutory functions and duties. It received representation and where necessary, issued determinations on parades and parade related protests. In line with best practice, the operational procedures of the Commission and the quality of data used by the Commission is kept under continuous review to ensure that the Commission is content that it is provided with all requisite information to enable it to make informed decisions.

Attendance at Commission meetings during 2019-20 is set out in the following table:

|

Commissioner

|

Commission Meeting Attendance

|

|

Anne Henderson (Chair)

|

35/36

|

|

Joelle Black

|

34/36

|

|

Sarah Havlin

|

29/36

|

|

Paul Hutchinson

|

31/36

|

|

Colin Kennedy

|

31/36

|

|

Anne Marshall

|

29/36

|

|

Geraldine McGahey

|

35/36

|

All meetings were quorate.

Strategic objectives were agreed to reflect the Commission’s statutory duties and functions, incorporating its strategic vision. The Commission uses these objectives as a basis for the 2019-20 Business Plan. The 2019-20 Business Plan can be found on the website.

The Commissioners completed a self-assessment, to evaluate their performance in 2019-20. The Commission is content that all areas are operating effectively.

Audit and Risk Committee

The Audit and Risk Committee supports the Accounting Officer and the Commission in their responsibilities for the management of risk and the effectiveness of the internal system of control and governance arrangements. The Committee fulfils this responsibility by reviewing whether proportionate assurances for meeting the Commission’s and Accounting Officer’s responsibilities are available and by testing the reliability and integrity of these assurances. This includes oversight of the effective operation and impact of the Framework Document and the Commission’s business planning process.

The Audit and Risk Committee is comprised of five Commissioners, and must have two Commissioners in attendance to be quorate. The Committee is also attended by the Accounting Officer, Deputy Secretary, Internal Audit, the National Audit Office (as external auditors), external accountant and representatives from the sponsor department. The Committee meets three times per year and more frequently as required. In addition to providing all Commissioners with a copy of the minutes of meetings of the Committee, the Chair of the Audit and Risk Committee briefs the Commission after each meeting.

Attendance at the Audit and Risk Committee is disclosed in table below:

|

Commissioner

|

Audit and Risk Committee Attendance

|

|

Anne Marshall (Chair)

|

4/4

|

|

Sarah Havlin

|

1/4

|

|

Geraldine McGahey

|

4/4

|

|

Colin Kennedy

|

4/4

|

|

Joelle Black

|

3/4

|

All meetings were quorate.

During the 2019-20 financial year, the Audit and Risk Committee advised the Commission on the following significant areas:

-

The accounting policies, the accounts and the annual report of the organisation, including the process for review of the accounts prior to submission for audit, level of errors identified and management’s letter of representation to the external auditors;

-

The risk management process;

-

The planned activity and results of both internal and external audit;

-

The adequacy of management responses to issues identified by audit activity, including the external auditor’s Audit Completion Report and the progress on the implementation of recommendations from internal and external audit reports; and

-

Specific, significant issues for the attention of the Committee.

Based on the views expressed by the Accounting Officer, the Internal Auditors and the External Auditors, the Committee was satisfied with its overall effectiveness.

Corporate Governance

The Commission conducts its affairs in accordance with a comprehensive corporate governance framework. Although not part of central government, the Commission is expected to comply with the principles set out in the Corporate Governance Code (Corporate governance in central government departments, code of good practice, published by HM Treasury and the Cabinet Office, April 2017) as far as applicable. The Commission has a comprehensive Framework Document agreed with the NIO which sets down its values and principles, roles and responsibilities and clear lines of accountability.

As interim Accounting Officer, I have responsibility for reviewing the effectiveness of the control environment. This review is informed by the work of staff who have the responsibility for the development and maintenance of the control framework, by the work of internal audit and by the findings of the external auditors in their report to those charged with governance and any other reports. I also complete Stewardship Statements bi-annually. These statements help to identify areas of improvement and provide assurances to the NIO’s Principal Accounting Officer on the effectiveness of management controls. The statements also inform the content of this Governance Statement.

Internal Audit Reports Submitted to Audit and Risk Committee

In 2019-20, ASM were internal auditors to the Parades Commission, appointed through a tender competition. The services provided by ASM operate to standards defined by the Public Sector Internal Audit Standards.

Internal Audit’s work plan is informed by an analysis of the risk to which the Commission is exposed and the plan is considered by the Audit and Risk Committee before it is agreed by the Commission.

Internal Audit’s findings are presented to the Audit and Risk Committee and copies of all final reports are sent to me, as Accounting Officer. In addition, Internal Audit provides an annual written statement to the Audit and Risk Committee, setting out a formal opinion on the adequacy and effectiveness of the Committee’s risk management, control and governance processes. Internal Audit conducted three reviews on the following activities during 2018-19:

-

Financial Systems;

-

Procurement and Contract Management; and

-

Follow-up review from 2018-19.

All of the above reports received ‘Satisfactory’ opinion ratings. There were eight Priority 3 recommendations made, these are low level recommendations which could result in some impact on a key organisational objective or could lead to an increased risk exposure. All of these recommendations have been accepted by management and will be implemented during 2020-21.

In the Annual Assurance Statement, the Internal Auditors stated that, during the year ended 31 March 2020, the Commission’s systems in relation to risk management, control and governance were adequate and operated effectively, thereby providing an overall ‘Satisfactory’ assurance in relation to the effective and efficient achievement of the Commission’s objectives.

Risk Assessment

The Commission’s corporate governance controls are designed to manage risk to a reasonable level rather than to eliminate all risk of failure to achieve policies, aims and objectives; it can therefore only provide reasonable and not absolute assurance of effectiveness. Risks are managed on an ongoing basis in a process that is designed to identify and prioritise the risks to the achievement of the Commission’s policies, aims and objectives; to evaluate the likelihood of those risks being realised and the impact should they be realised; and to manage them efficiently, effectively and economically. The system of internal control was in place for the year ended 31 March 2020 and up to the date of approval of the annual report and accounts, and accords with HM Treasury guidance.

The system is based on a framework of regular management information, administrative procedures, including the segregation of duties, and a system of delegation and accountability. In particular it includes:

-

Comprehensive budgeting systems with an annual budget which is reviewed and agreed by the Secretary to the Commission;

-

Regular reviews of periodic and annual financial reports which indicate financial performance; and

-

As appropriate, formal project management disciplines.

Throughout the year the Commission had a risk register in place that has been assessed and considered at management level. The register has been scrutinised, discussed at both the Audit and Risk Committee and Commission meetings.

The Commission operates a “traffic light” corporate risk register in line with Government guidance. The Commission revised its corporate risk register following feedback received from the internal auditors. Changes have been made to the format of the register and each risk has been assigned a risk owner. The register is kept under constant review, with a formal quarterly review, and update by management as necessary. Risks are identified and assessed in terms of likelihood of occurrence and impact of risk. Management considers signs of risks changing, examines existing risk control tools and, if necessary, takes remedial

action.

The Commission’s risks are identified by the Commissioners, by me as Accounting Officer and by my management team and they are ratified by the Audit and Risk Committee and the Commission. The risks have been ranked according to ‘Likelihood’ and ‘Impact’. We have also assessed what actions are in place, or need to be taken, to mitigate the organisational risks identified.

During the course of 2019- 20 our main risks were financial and reputational risks, including maintenance of IT systems and protection of our information. One risk has increased in 2019-20 regarding loss of knowledge due to staff turnover, as a result Secretariat staff contracts coming due for revision and also as a result of the existing vacancy at Secretary level. A new risk emerged at the end of the reporting period as a result of the global outbreak of Covid-19 and business continuity plans were activated to mitigate the impact and ensure that the Commission could continue with business as usual with minimal disruption; however, it is likely that Covid-19 will have a continuing impact on the work of the Commission. The NI Executive’s ‘Pathway to Recovery’ published on 12th May 2020, does not refer to parades, with emerging risks of various interpretations by different groups about when parades may safely recommence. The Commission continues to seek clarification on these regulations. These risks have been managed to an acceptable level and no significant control issues have materialised.

On-going operational risks are managed as follows:

-

all operational risks are identified, captured, evaluated and controlled by me and my management team and communicated to the Audit and Risk Committee;

-

Any changes to the assessment and evaluation of risk are noted by the Audit and Risk Committee and ratified by the full Commission; and

-

The full Commission has a responsibility to lead on determining and evaluating the Commission’s risks; and

-

Risks are communicated to staff by management, via regular staff meetings and in the risk register.

Personal Data Related Incidents

There were no personal data related incidents formally reported to the Information Commissioner’s Office.

Significant Internal Control Issues

There were no significant internal control issues identified during 2019-20. There is no relevant audit information of which the external auditors are unaware.

Events after the Reporting Period

A new Secretary was appointed in July 2020 and she will take up the role as Accounting Officer on 1st August 2020.

N Higgins

Deputy Secretary and

Interim Accounting Officer 8 July 2020

Parliamentary Accountability and Audit Report

-

-

The accounts of the Parades Commission for Northern Ireland are audited by the Comptroller and Auditor General under the Public Processions (Northern Ireland) Act 1998. The audit fee charged was £15,000 (£14,500 in 2018-19). The auditors received no fees for non-audit services. The auditors have been provided with all relevant audit information necessary to complete their audit and the Accounting Officer has taken all the necessary steps to ensure that the auditors are aware of any relevant information.

-

All expenditure was applied to the purpose intended by Parliament (audited).

-

No fees or charges were paid by the Parades Commission for Northern Ireland (audited).

-

The Parades Commission for Northern Ireland has no remote contingent liabilities (audited).

-

The Parades Commission for Northern Ireland had no losses or special payments (audited).

-

The Parades Commission for Northern Ireland’s net expenditure in 2019- 20 was £776,217. The total comprehensive expenditure for prior years was as follows:

Expenditure and income

|

|

2019-20

£

|

2018-19

£

|

2017-18

£

|

2016-17

£

|

|

Net Expenditure

|

776,217

|

720,078

|

727,560

|

722,231

|

|

Other Comprehensive Expenditure

|

(35)

|

(271)

|

(1,418)

|

(4,418)

|

|

Total Comprehensive Expenditure

|

776,182

|

719,807

|

726,142

|

717,813

|

N Higgins DeputySecretary and

Interim Accounting Officer 8 July 2020

Opinion on financial statements

I certify that I have audited the financial statements of the Parades Commission for Northern Ireland for the year ended 31 March 2020 under the Public Processions (Northern Ireland) Act 1998. The financial statements comprise: the Statements of Comprehensive Net Expenditure, Financial Position, Cash Flows, Changes in Taxpayers’ Equity; and the related notes, including the significant accounting policies. These financial statements have been prepared under the accounting policies set out within them. I have also audited the information in the Accountability Report that is described in that report as having been audited.

In my opinion:

-

the financial statements give a true and fair view of the state of the Parades Commission for Northern Ireland’s affairs as at 31 March 2020 and of net expenditure for the year then ended; and

-

the financial statements have been properly prepared in accordance with the Public Processions (Northern Ireland) Act 1998 and Secretary of State directions issued thereunder.

Opinion on regularity

In my opinion, in all material respects the income and expenditure recorded in the financial statements have been applied to the purposes intended by Parliament and the financial transactions recorded in the financial statements conform to the authorities which govern them.

Basis of opinions

I conducted my audit in accordance with International Standards on Auditing (ISAs) (UK) and Practice Note 10 ‘Audit of Financial Statements of Public Sector Entities in the United Kingdom’. My responsibilities under those standards are further described in the Auditor’s responsibilities for the audit of the financial statements section of my certificate. Those standards require me and my staff to comply with the Financial Reporting Council’s Revised Ethical Standard 2016. I am independent of the Parades Commission for Northern Ireland in accordance with the ethical requirements that are relevant to my audit and the financial statements in the UK. My staff and I have fulfilled our other ethical responsibilities in accordance with these requirements. I believe that the audit evidence I have obtained is sufficient and appropriate to provide a basis for my opinion.

Conclusions relating to going concern

I have nothing to report in respect of the following matters in relation to which the ISAs (UK) require me to report to you where:

-

the Parades Commission for Northern Ireland’s use of the going concern basis of accounting in the preparation of the financial statements is not appropriate; or

-

the Parades Commission for Northern Ireland have not disclosed in the financial statements any identified material uncertainties that may cast significant doubt about the Parades Commission for Northern Ireland’s ability to continue to adopt the going concern basis of accounting for a period of at least twelve months from the date when the financial statements are authorised for issue.

Responsibilities of the Commission and Accounting Officer for the financial statements

As explained more fully in the Statement of Accounting Officer’s Responsibilities, the Commission and the Accounting Officer are responsible for the preparation of the financial statements and for being satisfied that they give a true and fair view.

Auditor’s responsibilities for the audit of the financial statements

My responsibility is to audit, certify and report on the financial statements in accordance with the Public Processions (Northern Ireland) Act 1998.

An audit involves obtaining evidence about the amounts and disclosures in the financial statements sufficient to give reasonable assurance that the financial statements are free from material misstatement, whether caused by fraud or error. Reasonable assurance is a high level of assurance, but is not a guarantee that an audit conducted in accordance with ISAs (UK) will always detect a material misstatement when it exists. Misstatements can arise from fraud or error and are considered material if, individually or in the aggregate, they could reasonably be expected to influence the economic decisions of users taken on the basis of these financial statements.

As part of an audit in accordance with ISAs (UK), I exercise professional judgment and maintain professional scepticism throughout the audit. I also:

-

identify and assess the risks of material misstatement of the financial statements, whether due to fraud or error, design and perform audit procedures responsive to those risks, and obtain audit evidence that is sufficient and appropriate to provide a basis for my opinion. The risk of not detecting a material misstatement resulting from fraud is higher than for one resulting from error, as fraud may involve collusion, forgery, intentional omissions, misrepresentations, or the override of internal control.

-

obtain an understanding of internal control relevant to the audit in order to design audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Parades Commission for Northern Ireland’s internal control.

-

evaluate the appropriateness of accounting policies used and the reasonableness of accounting estimates and related disclosures made by management.

-

evaluate the overall presentation, structure and content of the financial statements, including the disclosures, and whether the financial statements represent the underlying transactions and events in a manner that achieves fair presentation.

-

conclude on the appropriateness of the Parades Commission for Northern Ireland’s use of the going concern basis of accounting and, based on the audit evidence obtained, whether a material uncertainty exists related to events or conditions that may cast significant doubt on the Parades Commission for Northern Ireland’s ability to continue as a going concern. If I conclude that a material uncertainty exists, I am required to draw attention in my report to the related disclosures in the financial statements or, if such disclosures are inadequate, to modify my opinion. My conclusions are based on the audit evidence obtained up to the date of my report. However, future events or conditions may cause the Parades Commission for Northern Ireland to cease to continue as a going concern.

I communicate with those charged with governance regarding, among other matters, the planned scope and timing of the audit and significant audit findings, including any significant deficiencies in internal control that I identify during my audit.

In addition, I am required to obtain evidence sufficient to give reasonable assurance that the income and expenditure reported in the financial statements have been applied to the purposes intended by Parliament and the financial transactions conform to the authorities which govern them.

Other Information

The Commission and the Accounting Officer are responsible for the other information. The other information comprises information included in the annual report, other than the parts of the Accountability Report described in that report as having been audited, the financial statements and my auditor’s report thereon. My opinion on the financial statements does not cover the other information and I do not express any form of assurance conclusion thereon. In connection with my audit of the financial statements, my responsibility is to read the other information and, in doing so, consider whether the other information is materially inconsistent with the financial statements or my knowledge obtained in the audit or otherwise appears to be materially misstated. If, based on the work I have performed, I conclude that there is a material misstatement of this other information, I am required to report that fact. I have nothing to report in this regard.

Opinion on other matters

In my opinion:

-

the parts of the Accountability Report to be audited have been properly prepared in accordance with Secretary of State directions made under the Public Processions (Northern Ireland) Act 1998;

-

in the light of the knowledge and understanding of the Parades Commission for Northern Ireland and its environment obtained in the course of the audit, I have not identified any material misstatements in the Performance Report or the Accountability Report; and

-

the information given in the Performance Report and Accountability Report for the financial year for which the financial statements are prepared is consistent with the financial statements.

Matters on which I report by exception