Annual Report and Financial Statements for the year ended 31 March 2023

Annual Report and Accounts 2022-2023 for the period 01/04/2022 to 31/03/2023

Presented to Parliament pursuant to Schedule 1 paragraphs 12 and 13 of the Public Processions (Northern Ireland) Act 1998

Ordered by The House of Commons to be printed 4th July 2023

© The Parades Commission for Northern Ireland copyright 2023

This publication is licensed under the terms of the Open Government Licence v3.0 except where otherwise stated. To view this licence, visit nationalarchives.gov.uk/doc/open-government-licence/version/3.

Where we have identified any third party copyright information you will need to obtain permission from the copyright holders concerned.

This publication is available at https://www.gov.uk/official-documents

Any enquiries related to this publication should be sent to us at Deputy Secretary, Parades Commission for Northern Ireland, Andras House, 60 Great Victoria Street, Belfast, BT2 7BB

E-number: E02907060

ISBN: 978-1-5286-4098-5

Printed on paper containing 40% recycled fibre content minimum

Printed in the UK by HH Associates Ltd. on behalf of the Controller of His Majesty’s Stationery Office

Contents

FOREWORD BY THE CHAIR

I am pleased to present this annual report which covers the period from 1 April 2022 to 31 March 2023. With COVID restrictions gone we saw a welcome return to parading.

We have always been keen to hear people’s views first hand. Very often as a key part of our Wednesday meetings MPs, MLAs, local councillors, community leaders, supporters or concerned residents come and engage with us. These conversations are an essential part of our decision making, as we weigh up at times competing considerations about a particular route or parade. The Commission is most appreciative of all who take the time and trouble to engage with us.

The removal of COVID restrictions also meant that Commissioners and Commission staff could now get out and about across Northern Ireland. These outreach visits have given us invaluable insights into the particular issues concerning parades in a particular community and enabled constructive conversations to take place. We have responded positively to every invitation we have received. We have seen how local dialogue can facilitate local accommodations – the ideal solution for disputes about parades. Results from the recent Life and Times survey indicated that 79% of respondents agreed that dialogue between organisers and residents helps reduce tensions around parading.

I pay tribute to our excellent Secretariat and to my fellow Commissioners who bring a wealth of experience to our discussions. I can reassure everyone that we will carry out our statutory functions without fear or favour, and decisions are only reached after detailed scrutiny of all factors. Commissioners and Secretariat frequently monitor parades.

Engagement probably best sums up what we have tried to do in the period covered by this report. At times we have seen real progress. In the coming year we will continue and further develop our engagement with our stakeholders as we strive to build on progress made in previous years, so that parading can continue to take place in a peaceful and collaborative manner with respect and dialogue at its heart.

The Very Revd Dr Graham Forbes CBE

Chair

OVERVIEW

The Parades Commission was established on 27 March 1997, initially as a non-statutory body. The Public Processions (Northern Ireland) Act 1998, amended by the Public Processions (Amendment) Northern Ireland Order 2005, gives the Commission statutory responsibilities in relation to regulating public processions and related protests.

The Parades Commission operates from a single site in Belfast City Centre. Contact details are as follows:

Parades Commission

2nd floor, Andras House 60 Great Victoria Street

Belfast

BT2 7BB

Telephone: 028 9089 5900

E-mail info@paradescommissionni.org

Web: www.paradescommission.org

The Commission’s statutory role is set out in the Public Processions (Northern Ireland) Act 1998. Section 2 (1) of that Act provides that:

“It shall be the duty of the Commission –

-

to promote greater understanding by the general public of issues concerning public processions;

-

to promote and facilitate mediation as a means of resolving disputes concerning public processions;

-

to keep itself generally informed as to the conduct of public processions and protest meetings;

-

to keep under review, and make such recommendations as it thinks fit to the Secretary of State concerning, the operation of the Act.”

And Section 2(2) provides that:

“The Commission may in accordance with the provisions of this Act:

-

facilitate mediation between parties to particular disputes concerning proposed public processions and take such other steps as appear to the Commission to be appropriate for resolving disputes; and

-

issue determinations in respect of particular proposed public processions.”

The Commission is currently made up of six Commissioners, including a Chair. The Commissioners are appointed by the Secretary of State for Northern Ireland. A secretariat supports the Commission in the delivery of its statutory responsibilities as set out in the Act.

The Secretary to the Commission, Sarah Teer, took up the post on the 1st July 2020. The Secretary is responsible for the effective operation of the secretariat and for managing its financial and human resources.

The Secretariat is responsible for providing advice and support to the Chair and Commissioners in support of their aims and objectives, and in undertaking their statutory responsibilities. The Secretariat had an average of 6 staff in post over the year. The Commission also made use of services provided by external professionals such as media services, auditors and an accountant.

FINANCIAL STATEMENTS

Under paragraph 12 (1) of Schedule 1 to the Public Processions (Northern Ireland) Act 1998, as amended by the Public Processions (Northern Ireland) Act 1998 (Accounts and Audit) Order 1998, the Commission is required to:

-

keep proper accounts and proper records in relation to the accounts; and

-

prepare a statement of accounts in respect of each financial year of the Commission.

The accounts have been prepared in accordance with a direction issued by the Northern Ireland Office (NIO) under the 1998 Act. The accounts incorporate a Statement of Comprehensive Net Expenditure, a Statement of Financial Position, a Statement of Cash Flows, a Statement of Changes in Taxpayers’ Equity and related notes.

GOING CONCERN

The Statement of Financial Position at 31 March 2023 shows net liabilities of £110,653 (2022: £82,368). In addition, there are lease liabilities committed for future years of £23,553 (2022: £62,253).

The Commission prepares financial statements in accordance with the FReM, which has adapted going concern for non-trading entities to be based on the anticipated continuation of the provision of a service in the future, as evidenced by inclusion of financial provision for that service in published documents.

The Commission’s sponsoring body is the Northern Ireland Office as laid out in the Public Processions (Northern Ireland) Act 1998. The Commission’s budget for 2023-24 has been approved by the Northern Ireland Office, and we received a three year financial settlement as part of the UK Government Spending Review covering the period 2022-25. In addition, as a result of the Commission’s project budget shortfall in 2023-24 the Commission has engaged with its sponsoring body the Northern Ireland Office who have provided a letter of support that confirms the provision of financial support to the Commission by the Northern Ireland Office, to assist it in meeting its liabilities as and when they fall due, but only to the extent that money is not otherwise available to the Commission to meet such liabilities.

The Northern Ireland Office have confirmed that they have the ability to provide such support and will provide this support to the Commission, to the extent outlined above, for a period of 12 months from the date of approval of the Commissions’ balance sheet.

As a result at the date of this report, with this letter of support in place, the Accounting officer has considered it appropriate to adopt a going concern basis for the preparation of the 2022-23 financial statements.

PARADING ACTIVITIES

The current legislation requires that all public processions, with the exception of funerals and Salvation Army organised parades, are notified to the police at least 28 days before the date of the parade. Parade related protests are required to be notified to the police at least 14 days before the date of the parade. These notices are then passed on to the Parades Commission. Notifications can be submitted manually at a Police Service for Northern Ireland (PSNI) station or by using the on-line notification function on the website www.paradescommission.org

This reporting period has seen public processions and procession related protests increase to close to pre pandemic levels.

There was an increase (1,097) in the number of notified parades and parade related protests taking place during 2022-23 when compared with the previous year.

Table 1: detailed breakdown of Parades and Parade related protests notified to take place during the reporting period

|

Parades and Parade related protests |

2022-23 |

2021-22 |

2020-21 |

|

Total notifications received:

|

3,585

|

2,488

|

1,113

|

|

Protestant/Unionist/Loyalist notifications

|

2,558

|

1,846

|

690

|

|

Catholic/Republican/Nationalist notifications

|

92

|

42

|

30

|

|

“other” notifications*

|

935

|

600

|

393

|

|

|

|

|

|

|

Total notifications considered sensitive:

|

177

|

141

|

59

|

|

Protestant/Unionist/Loyalist sensitive**

|

162

|

135

|

52

|

|

Catholic/Republican/Nationalist sensitive

|

1

|

2

|

1

|

|

“others”

|

14

|

4

|

6

|

|

|

|

|

|

|

Number of parades or parade related protests with conditions imposed:

|

154

|

120

|

19

|

|

Protestant/Unionist/Loyalist sensitive**

|

152

|

118

|

18

|

|

Catholic/Republican/Nationalist sensitive

|

1

|

2

|

1

|

|

“others”

|

1

|

0

|

0

|

*Other category includes charity, civic, rural and sporting events, as well as church parades. Collectively, these made up 26 percent of the overall total number of parades.

**Protestant/Unionist/Loyalist (PUL) sensitive parades include 51 notified weekly protest parades in Portadown.

Sensitive Parades and Parade Related Protests

Some parades and parade related protests are deemed “sensitive” as they have the potential to raise concerns and community tensions. In making its decisions, the Commission seeks to balance the conflicting rights of different groups within the statutory criteria laid down in the legislation. It approaches all “sensitive parades” independently and fairly.

In 2022-23, 154 parades and parade related protests were subject to restrictions (2021-22:120 and 2020-21:19). The type of restrictions placed on parades or parade related protests include the route, size and timing of a parade or parade related protest, type of music to be played, behaviour and dress code.

The Commission’s overall objective is to help bring about a situation in which parades can take place peacefully in an atmosphere of mutual respect.

KEY ISSUES AND RISKS THAT COULD AFFECT THE COMMISSION IN DELIVERY OF ITS OBJECTIVES

The principal risk identified is anything that would prevent the Commission from discharging its statutory duties in respect of notified processions and related protests. The highest ranking risks relate to our infrastructure, including provision and maintenance of IT systems, financial risks due to increased costs and protection of information. The current political landscape is challenging with no functioning Executive or Assembly. The Commission continues to monitor these political outworkings and any impacts they may have on its work. We will continue to engage with all stakeholders to encourage them to adhere to their obligations as per the Public Processions (Northern Ireland) Act 1998.

Within the executive processes of the Parades Commission, there is embedded a corporate risk register in line with Government guidance. Risks are identified, assessed in terms of likelihood and impact, and then ranked in terms of priority.

The risk register is kept under constant review and updated as necessary. Management consider signs or warnings of risks altering, examine existing controls to reduce or manage risks and, if necessary, take additional action.

PERFORMANCE ANALYSIS

In line with its sponsor department, the Northern Ireland Office, the Commission took an outcomes based accountability approach to its business planning this year. The below table details its key objectives, activities, performance measures and outcomes.

|

Objective 1

|

Parades notifications are processed and published on the Commission website in a timely manner

|

|

Key activities

|

-

Process and publish all parade notifications on the Commission website

-

Hold formal meetings throughout the year for full consideration of sensitive parades

-

Gather information and evidence to ensure it takes into account all relevant factors

-

Draft determinations/decisions, where appropriate, following full consideration of all factors

-

Issue determinations/decisions in a timely manner

|

|

Measures

|

Outputs

|

|

# of notifications processed and uploaded to PCNI website

|

3612

*this includes parades processed during the reporting period notified to take place outside the reporting parade. 3585 parades were notified to take place during this period (this does not include those that were withdrawn by the organiser).

|

|

# of sensitive notifications considered by the Commission

|

179 sensitive notifications considered during the reporting period. (177 of which were notified to take place during the reporting period).

|

|

# of determinations/ decisions issued within 5 days of the Commission meeting

|

179

|

|

Objective 2

|

A greater understanding by the public of issues concerning public processions

|

|

Key activities

|

-

Include context to determinations/decisions to provide background to the decision making process and aid understanding

-

Make ourselves available for engagement with stakeholders and all members of society

-

Respond to media enquiries and other correspondence, as appropriate

-

Initiate survey work with NI Life and Times

|

|

Measures

|

Outputs

|

|

# of determinations which contain context to the Commission’s decision making process

|

158

*there were 21 no action letters issued

|

|

# of media enquiries dealt with

|

22

|

|

Trend change in attitude/perception of the general public on the stability of parading in Northern Ireland

|

4 questions included in Life and Times Survey.

|

|

Objective 3

|

The Commission is kept informed of parading issues, including the conduct of public processions and protest meetings

|

|

Key activities

|

-

Engage proactively with parade and protest organisers, elected and community representatives and other stakeholders

-

Gather information and evidence to ensure the Commission has a comprehensive range of data on which to base decisions

-

Observe identified parades and prepare reports on the conduct of those parades

-

Monitor media reports and statements relating to processions and protest meetings and attend relevant events

|

|

Measures

|

Outputs

|

|

# of sensitive parades which the Commission has engagement with stakeholders

|

179

|

|

# of parades observed

|

35 (however some of these parades included multiple notifications for 12th July)

|

|

# of observer reports prepared

|

35 updates provided at Commission meetings and recorded in Minutes

|

|

Objective 4

|

Mediation is promoted and used as a means to resolve parading disputes

|

|

Key activities

|

-

Explore mediation in areas where local agreement has not been reached, to ensure that the parties are made aware of the benefits of dialogue

-

Facilitate mediation where appropriate

|

|

Measures

|

Outputs

|

|

# of parading disputes in which mediation is facilitated

|

The Commission has had significant engagement with stakeholders and has continued to undertake outreach. The Commission has not identified any circumstances which it considers formal mediation the appropriate form of action at the present time. The Commission does not have the legal power to force parties into mediation. For mediation to be meaningful and productive all parties must be willing to engage with the process. The Commission has however seen some local engagement and accommodations reached.

|

|

Objective 5

|

Effective succession planning for the appointment of Commissioners and Secretariat staff

|

|

Key activities

|

-

Ensure staffing levels are adequate to discharge functions

-

Advertise Secretariat vacancies in a timely manner

-

Identify when vacancies in the Commission are likely to arise and liaise with NIO with regard to replacements

-

Ensure a suitable induction programme is in place and is provided to all Commissioners and members of the Secretariat

|

|

Measure

|

Outputs

|

|

# and % of secretariat vacancies unfilled for one month or more

|

0

|

|

# and % of Commissioner vacancies

|

0

|

|

% of staff and Commissioners who complete mandatory training

|

100% of Secretariat

85% Commissioners

|

|

Objective 6

|

High standards of governance and stewardship maintained

|

|

Key activities

|

-

Audit and Risk Committee meet on a regular basis

-

Ensure adequate and appropriate systems are in place

-

Regularly review and monitor progress against the Business Plan

-

Regularly review and update Risk Register

-

Complete Stewardship statements

-

Attend governance meetings with Sponsor body

-

Completion of Annual Report and Accounts in a timely manner

-

Implementation of audit recommendations

-

Training for Commissioners and Secretariat

-

Completion of Audit Self Assessment

-

Completion of Commissioners’ self assessment audit

-

Regular monitoring of budget to ensure spend within budget

|

|

Measure

|

Outputs

|

|

# of Audit and Risk Committee meetings

|

4

|

|

# of Internal Audit Reports with an overall rating of satisfactory

|

2

|

|

% spend against budget

|

The Commission finished the financial year in a 6.3% underspend position.

|

|

Completion and publication of Annual Report and Accounts as per statute

|

Completed. Annual Report and Account published and laid before parliament July 2022

|

SUSTAINABILITY REPORT

The Commission has received a de minimus exemption from reporting on the full spectrum of sustainability requirements on the grounds that it is an Arms Length body with a staff complement of 7 and a floor space of 175m2.

The Commission has a recycling policy that involves the recycling of dry office waste, recycling of print cartridges and using electronic means of communication were possible.

The Secretariat has developed an action plan to reduce the reliance on paper within the office practices using an electronic document record management system. The Commission uses a web based system for providing meeting papers to Commissioners and as a default uses e-mail rather than hard copy correspondence were possible. No A4 paper was purchased this year with existing supply being sufficient.

From March 2015, parade and protest organisers are able to notify parades and parade related protests on-line, reducing use of paper. The number of on-line notifications in 2022-23 was 72 per cent of total notifications, with 28 per cent being submitted in hard copy via the PSNI.

Over the reporting period the Commission has moved to a hybrid work model reducing the carbon footprint of staff and Commissioners travelling to the office, also resulting in the reduction in use of electricity.

The Commission used 9786 units of electricity with a total spend on electricity of £3,227.

The Commission encourages the use of car pools and public transport for travelling to business engagements.

Over the reporting period the Commission’s total spend on business related travel was £7,257. This was an increase on last year’s spend due to a greater number of engagements with stakeholders, an increase in the cost of airfares and an increase in the number of parades being monitored.

S Teer

Secretary and

Accounting Officer 26 June 2023

ACCOUNTABILITY REPORT

Background

The Parades Commission for Northern Ireland is a non-departmental public body sponsored by the Northern Ireland Office. Created on 27 March 1997, its statutory responsibilities are set out in the Public Processions (Northern Ireland) Act 1998, amended by the Public Processions (Amendment) Northern Ireland Order 2005.

The Budget for the Commission is set by the Secretary of State for Northern Ireland and the financial activities form part of the NIO Resource Departmental Expenditure Limits (DEL) and Capital DEL estimates. In 2022-23, the Commission was allocated a budget of £771,156. Efficiencies were achieved during 2022-23 due to the reduction of a full time member of administration staff to a six month agency recruitment and some Commission meetings taking place virtually reducing travel expenses. This resulted in reduced funding of £694K being received from NIO.

The Directors of the Commission comprise the Secretary and the Commissioners. Sarah Teer was appointed Secretary and Accounting Officer on 1 July 2020.

ROLE OF THE CHAIR OF THE PARADES COMMISSION

The Chair is required to attend and chair Commission meetings, ensuring that these meetings are at appropriate intervals. The Chair must develop policy and provide strategic direction to the Commission to enable the effective and efficient performance of its statutory duties. The Chair must ensure personal and corporate compliance with the Code of Practice for Members of the Commission. The Chair must accept corporate responsibility for ensuring that the Commission complies with any statutory or administrative requirements for its use of public resources (including the promotion of regularity, propriety and value for money). The Chair shall assess the effectiveness and performance of the individual members of the Commission and report those assessments to the NIO.

COMMISSION MEMBERS

Members are appointed by the NIO. From January 2021 a new Commission was appointed on a three year term. From 1 April 2022 until 31 March 2023, membership of the Commission was as follows:

VERY REVD DR GRAHAM FORBES (Chair)

The Very Revd Dr Graham Forbes CBE is a retired Anglican clergyman and former Provost of St Mary’s Cathedral, Edinburgh. His wide variety of public appointments include Chair of Court, Edinburgh Napier University, and Chair of the Scottish Committee of University Chairs. A former member of the Parole Board, he served as HM (Lay) Inspector of Constabulary, as Chair of Scottish Criminal Cases Review Commission, and also as a member of the Security Vetting Appeals Panel. Within health he served on the General Medical Council, chaired the Scottish Parliament’s Expert Group on the safety of the MMR vaccine and chaired the Mental Welfare Commission for Scotland. He chaired OSCR, Scotland’s charity regulator and was a member of the Armed Forces Pay Review Body. He is the Portuguese Hon Consul in Scotland. He was awarded the CBE in 2003.

JOELLE BLACK

Joelle was appointed to the Commission in May 2018. Joelle is a Barrister-at-law and has been a Principal Public Prosecutor with the Public Prosecution Service for Northern Ireland since 2008. During this period, Joelle was seconded by the Foreign and Commonwealth Office to EULEX Kosovo as a Special Prosecutor.

MARIAN CREE

Marian Cree is Legal Service Oversight Commissioner for Northern Ireland and formerly the Northern Ireland representative at the Competition and Markets Authority.

EIMEAR Mc ALLISTER

Eimear Mc Allister has been a barrister in private practice and has worked at a senior level in legal services regulation and in financial dispute resolution. She has held a variety of adjudication roles since 2017 including at High Speed Two, the Health and Care Professions Council and The Appeals Service.

DEREK WILSON

Derek Wilson is a former banker who chaired the Northern Ireland mortgage committee of UK Finance. He currently serves on a number of boards, committees and governing bodies, including the Northern Ireland Housing Executive Board where he chairs the Resources and Performance Committee, having previously served on the Audit and Risk Assurance Committee for over five years. He is the Non-Executive Chair of the Northern Ireland Medical and Dental Training Agency, he sits on the Co-ownership Board, is a member of the governing body of the South Eastern Regional College and serves as a lay member on the Statutory Committee of the Pharmaceutical Society of NI.

BILLY GAMBLE

Billy Gamble now works as a Strategy Consultant following his retirement as a senior civil servant in the Northern Ireland Civil Service. During his civil service career, he held roles including Director of Equality and Head of Good Relations and Reconciliation Division in the Office of the First and Deputy First Minister, and Director of Regional Planning and Transportation in the Department for Regional Development.

He has previously held a number of board and trustee appointments, including membership of the board of the International Fund for Ireland, the Equality Commission for Northern Ireland, the Community Relations Council, the Integrated Education Fund and Community Foundation for Northern Ireland.

REGISTER OF INTERESTS

Commission members and senior secretariat staff are required to provide information of personal or business interests that might be perceived by a reasonable member of the public to influence their judgement in the exercise of their public duty. The Parades Commission maintains a register of interests which is available for public inspection. No interests were declared which may be perceived to conflict with their regulatory role or management responsibilities.

PERSONAL DATA RELATED INCIDENTS

There were no personal data related incidents formally reported to the Information Commissioner’s Office.

REMUNERATION AND STAFF REPORT

REMUNERATION POLICY

The remuneration of the Chair and Commissioners is determined by the Secretary of State for Northern Ireland.

The Parades Commission does not directly employ staff, it seconds staff from the Home Civil Service (HCS), the Northern Ireland Civil Service (NICS) or via the interchange scheme.

For senior civil servants seconded from HCS, the remuneration is set by the Prime Minister, following independent advice from the Review Body on Senior Salaries. In reaching its recommendations, the Review Body has regard to the following considerations:

-

the need to recruit, retain and motivate suitably able and qualified people to exercise their responsibilities;

-

regional/local variations in labour markets and their effects on the recruitment and retention of staff;

-

Government policies for improving the public services, including the requirement on departments to meet the output targets for the delivery of departmental services;

-

the funds available to departments as set out in the Government’s departmental expenditure limits; and

-

Government’s inflation target.

For senior civil servants seconded from NICS, the remuneration is set by the Minister for Finance and Personnel following independent advice from the Review Body on Senior Salaries.

Further information about the work of the Review Body can be found at www.ome.uk.com.

The remuneration of all senior civil servants is entirely performance-related. Performance is appraised by line managers in respect of achievement of agreed objectives.

SERVICE CONTRACTS

The Constitutional Reform and Governance Act 2010 requires HCS appointments to be made on merit on the basis of fair and open competition. The Recruitment Principles published by the Civil Service Commission specify the circumstances when appointments may be made or otherwise. Unless otherwise stated below, the officials covered by this report hold appointments which are open-ended. Further information about the Civil Service Commissioners can be found at www.civilservicecommission.org.uk

NICS appointments are made in accordance with the Civil Service Commissioners for Northern Ireland’s Recruitment Code, which requires appointment to be on merit on the basis of fair and open competition but also includes the circumstances when appointments may otherwise be made. Unless otherwise stated below, the officials covered by this report hold appointments which are open-ended. Policy relating to notice periods and termination payments is contained in the NICS Staff Handbook. Further information about the Civil Service Commissioners can be found at www.nicscommissioners.org/

Details of salaries and allowances paid, benefits in kind and accrued pension entitlement are shown below.

COMMISSIONERS’ NUMBERS AND COSTS (AUDITED)

The total emoluments of the Commissioners (including the Chair) during the year ended 31 March 2023 amounted to £160,000 (2021-22: £159,987) and the expenses incurred by the Commissioners were £6,645 (2021-22: £6,528). Both the Chair and Commissioners are non-Northern Ireland Civil Service, therefore their salaries are not pensionable. The salary received by the Chair and Commissioners for 2022-23 was as follows:

|

Commission Member

|

2022-23

|

2021-22

|

|

|

Salary Range

£’000

|

Benefits in Kind (to nearest £100)

|

Salary Range

£’000

|

Benefits in Kind (to nearest £100)

|

|

Graham Forbes (Chair)

|

50-55

|

-

|

50-55

|

-

|

|

Joelle Black

|

20-25

|

-

|

20-25

|

-

|

|

Marian Cree

|

20-25

|

-

|

20-25

|

-

|

|

Derek Wilson

|

20-25

|

-

|

20-25

|

-

|

|

Eimear McAllister

|

20-25

|

-

|

20-25

|

-

|

|

Billy Gamble

|

20-25

|

-

|

20-25

|

-

|

The Chair and Commissioners are all appointed for a three year term.

The Commissioners are expected to devote approximately two days per week to Commission business over the course of a year, with a proportionately greater commitment required during the summer months.

REMUNERATION (INCLUDING SALARY) AND PENSION ENTITLEMENTS 2022-23 – AUDITED

|

Single Total Figure of Remuneration

|

|

Officials

|

Salary (£’000)

|

Performance Pay or Bonus payments (£’000)

|

Non-Cash Benefits (to nearest £100)

|

Pension Benefits (to nearest £1,000) (£’000)

|

Total (£’000)

|

|

|

2022

-23

|

2021

-22

|

2022

-23

|

2021

-22

|

2022

-23

|

2021

-22

|

2022

-23

|

2021

-22

|

2022

-23

|

2021

-22

|

|

Sarah Teer

|

75 - 80

|

70 - 75

|

-

|

-

|

-

|

-

|

15

|

15

|

90 - 95

|

85 - 90

|

No bonus payments were paid in 2022-23, (2021-22: none).

Total remuneration includes salary, non-consolidated performance-related pay, benefits-in-kind as well as severance payments. It does not include employer pension contributions and the cash equivalent transfer value of pensions.

SALARY

This report is based on accrued payments made by the Commission and thus recorded in these accounts. “Salary” includes gross salary; overtime; recruitment and retention allowances; private office allowances and any other allowances to the extent that it is subject to UK taxation.

BENEFITS IN KIND

The monetary value of benefits in kind covers any benefits provided by the Parades Commission and treated by HM Revenue and Customs as a taxable emolument. There were no benefits-in-kind in 2022-23, (2021-22: none).

BONUSES

Bonuses are based on performance levels attained and are made as part of the appraisal process. Bonuses relate to the performance in the year in which they become payable to the individual. There were no bonuses paid in 2022-23 or 2021-22.

PENSION BENEFITS

|

Pension Entitlements

|

|

|

Real increase in pension at pension age and lump sum at

31/3/23

|

Total accrued pension at pension age at 31/03/23 and related lump sum

|

Cash Equivalent Transfer Value at 31/03/23

|

Cash Equivalent Transfer Value at 31/03/22

|

Real increase in CETV

|

|

|

£000

|

£000

|

£000

|

£000

|

£000

|

|

Sarah Teer

|

0-2.5

|

15-20

|

163

|

140

|

2

|

PENSION ARRANGEMENTS

The Secretary is a member of the Local Government Pension Scheme (Northern Ireland) (the Scheme) which is a funded defined benefit scheme, which provides retirement benefits for Council employees on a “career average revalued earnings” basis from 1 April 2015. Prior to that date benefits were built up on a “final salary” basis.

From 1 April 2015, a member builds up retirement pension at the rate of 1/49th pensionable pay for each year. Pension benefits in relation to membership between 1 April 2009 and 31 March 2015 were built up at the rate of 1/60th pensionable pay for each year of membership. There is no automatic lump sum provided in respect of membership after 31 March 2009. Pension benefits in relation to any membership before 1 April 2009 were built up at the rate of 1/80th (pension) and 3/80ths (tax-free lump sum) of pensionable pay for each year of membership up to 31 March 2009. At retirement, members may give up some pension for additional lump sum, subject to HM Revenue and Customs (HMRC) limits. The conversion rate is £12 additional lump sum for every £1 of pension given up.

The scheme is funded by contributions made by both employees and employers. Prior to 1 April 2009, a member’s contribution rates were fixed at 6% of their pensionable remuneration (except for those who were entitled to contribute to the Scheme at 5% before 1 February 2003 and have remained in continuous employment). Tiered member contribution rates, determined by the whole-time equivalent rate of pay, were introduced from 1 April 2009. From 1 April 2015, the member contribution rates are determined on the actual rate of pay.

The ranges for the bands for tiered contribution rates are revised by the Department for Communities in April each year in accordance with the increase applied to a pension in payment.

The bands, effective from 1 April 2020 were as follows:

Employee Contribution Rates

|

Band

|

Range

|

Employee Contribution Rate

|

|

1

|

£0-£15,000

|

5.5%

|

|

2

|

£15,001- £22,900

|

5.8%

|

|

3

|

£22,901 – £38,300

|

6.5%

|

|

4

|

£38,301 - £46,400

|

6.8%

|

|

5

|

£46,401 - £91,900

|

8.5%

|

|

6

|

More than £91,901

|

10.5%

|

Employers’ contributions rates are determined by the fund’s actuary every three years at the triennial valuation. A formal triennial actuarial valuation of the Fund as at 31 March 2019 was carried out in 2019/20 and set the employer contribution rates for the 3 years commencing 1 April 2020 as follows:

Employer Contribution Rates

|

Year

|

Employer Contribution Rate

|

|

1 April 2020 – 31 March 2021

|

19.5%

|

|

1 April 2021 – 31 March 2022

|

19.5%

|

|

1 April 2022 – 31 March 2023

|

19.5%

|

The Local Government Pension Scheme Regulations (Northern Ireland) 2014 were made on 27 June 2014 and The Local Government Pension Scheme (Amendment and Transitional Provisions) Regulations (Northern Ireland) 2014 were made on 30 June 2014. Both sets of regulations are effective from 1 April 2015.

Cash Equivalent Transfer Values

A Cash Equivalent Transfer Value (CETV) is the actuarially assessed capitalised value of the pension scheme benefits accrued by a member at a particular point in time. The benefits valued are the member’s accrued benefits and any contingent spouse’s pension payable from the scheme. A CETV is a payment made by a pension scheme or arrangement to secure pension benefits in another pension scheme or arrangement when the member leaves a scheme and chooses to transfer the benefits accrued in their former scheme. The pension figures shown relate to the benefits that the individual has accrued as a consequence of their total membership of the pension scheme, not just their service in a senior capacity to which disclosure applies. The CETV figures, and from 2003-04 the other pension details, include the value of any pension benefit in another scheme or arrangement which the individual has transferred to the NICS pension arrangements. They also include any additional pension benefit accrued to the member as a result of their purchasing additional years of pension service in the scheme at their own cost. CETVs are calculated in accordance with The Occupational Pension Schemes (Transfer Values) (Amendment) Regulations 2015 and do not take account of any actual or potential benefits resulting from Lifetime Allowance Tax which may be due when pension benefits are taken.

Real increase in CETV

This reflects the increase in CETV effectively funded by the employer. It does not include the increase in accrued pension due to inflation, contributions paid by the employee (including the value of any benefits transferred from another pension scheme or arrangement) and uses common market valuation factors for the start and end of the period. However, the real increase calculation uses common actuarial factors at the start and end of the period so that it disregards the effect of any changes in factors and focuses only on the increase that is funded by the employer.

McCloud Remedy

Discrimination identified by the courts in the way the 2015 pension reforms were introduced must be removed by the Department of Communities. It is expected that, in due course, eligible members with relevant service between 1 April 2015 and 31 March 2022 may be entitled to different pension benefits in relation to that period. This is known as ‘McCloud Remedy and will impact many aspects of the Local Government Pension Scheme. At this stage allowance has not yet been made within CETVs for the remedy. More information on the McCloud Remedy can be found on the NILGOSC website.

COMPENSATION FOR LOSS OF OFFICE (Audited)

There were no redundancy or departure costs paid or payable by the Parades Commission in 2022-23 or 2021-22 in respect of Civil Service or other compensation schemes.

PAYMENTS TO PAST DIRECTORS (Audited)

No payments have been made to any person who was not a Director at the time the payment was made, but who had been a Director previously.

FAIR PAY DISCLOSURE (Audited)

The Commission is required to disclose the relationship between the remuneration of the most highly-paid Director, as disclosed in the remuneration table on page 20, in the organisation and the 25th, 50th and 75th percentile remuneration of the organisation’s workforce.

Total remuneration represents salary and allowances as there were no bonuses, performance pay or non-cash benefits provided to employees this year (none in 2021-22). Staff are seconded from other organisations and their remuneration is set in line with the relevant HR policies within those organisations.

|

|

2022-23

Total Remuneration

|

2021-22

Total Remuneration

|

% change

|

|

Band of Highest Paid Director’s FYE Total Remuneration

|

£000

75-80

|

£000

70-75

|

7%

|

|

Bonuses and Performance Pay

|

-

|

-

|

-

|

|

25th Percentile

|

£27,421

|

£23,239

|

18%

|

|

Ratio 25th percentile

|

2.83

|

3.12

|

|

|

Median 50th Percentile

|

£31,758

|

£29,173

|

9%

|

|

Ratio 50th Percentile

|

2.44

|

2.49

|

|

|

75th Percentile

|

£39,922

|

£35,002

|

14%

|

|

Ratio 75th Percentile

|

1.94

|

2.07

|

|

|

Total remuneration (excluding pension)

|

£429,846

|

£413,249

|

4%

|

The highest paid Director in the Parades Commission in the financial year 2022-23 was paid in the band £75,000 - £80,000 (2021-22 was £70,000 - £75,000). In 2022-23, the salary of the highest paid Director, was 2.44 times (2021-22: 2.49 times) the median remuneration of the workforce, which was £31,758 (2021-22: £29,099).

From 2021/22 to 2022/23 there was a very minor decrease in the pay ratios (ratio 40th percentile 2.49 (21/22) to 2.44 (22/23)). This reflects the pay and benefits of the entity’s employees taken as a whole. There has been no change in the Commission’s employment model. The Commission believes the median pay ratio for the relevant financial year is consistent with the pay, reward and progression policies for its workforce taken as a whole.

Remuneration ranged from £25,000 to £80,000 (2021-22: £20,000 to £75,000).

The calculations exclude the remuneration to the Commissioners as their employment terms and conditions, including rates of remuneration, are determined by the United Kingdom Government, and the Parades Commission for Northern Ireland is unable to influence those rates. Details of their remuneration are provided above.

STAFF REPORT

Number of Senior Civil Service Staff

|

Grade of Senior Civil Servant

|

2022-23

Number of Staff

|

2021-22

Number of Staff

|

|

5

|

1

|

1

|

Staff Numbers and Costs (Audited)

The average number of full-time equivalent persons engaged during the year was as follows:

|

|

2022-23

|

2021-22

|

|

Total

|

Commissioners*

|

Seconded Staff

|

Agency Staff

|

Total

|

|

Directly Engaged

|

6.00

|

6.00

|

|

|

6.00

|

|

Other

|

6.51

|

|

5.93

|

0.58

|

6.80

|

|

Total

|

12.51

|

6.00

|

5.93

|

0.58

|

12.80

|

* The Commissioners are expected to devote approximately two days per week to Commission business over the course of a year, with a proportionately greater commitment required during the summer months. Each commissioner is included as one whole-time equivalent person in the above numbers.

|

|

|

2022-23

|

2021-22

|

|

|

Seconded staff

|

Agency Staff

|

Total

|

Total

|

|

|

£

|

£

|

£

|

£

|

|

Wages and Salaries

|

413,221

|

18,382

|

431,603

|

413,249

|

|

Social security costs

|

45,382

|

-

|

45,382

|

42,070

|

|

Other pension costs

|

48,963

|

-

|

48,963

|

45,382

|

|

Total net costs

|

507,566

|

18,382

|

525,948

|

500,701

|

Staff Composition

|

|

2022-23

|

2021-22

|

|

Total Average Number of Persons Engaged

|

Average Number of Female Persons Engaged

|

Average Number of Male Persons Engaged

|

Total Average Number of Persons Engaged

|

Average Number of Female Persons Engaged

|

Average Number of Male Persons Engaged

|

|

Commissioners

|

6.00

|

3.00

|

3.00

|

6.00

|

3.00

|

3.00

|

|

Senior Civil Service

|

1.00

|

1.00

|

0

|

1.00

|

1.00

|

0

|

|

Secretariat Staff

|

5.51

|

1.93

|

3.58

|

5.8

|

1.00

|

4.8

|

|

Total

|

12.51

|

5.93

|

6.58

|

12.8

|

5.00

|

7.8

|

Average Staff Turnover

The Commission does not currently employ staff, all members of the Secretariat are on secondment or are agency workers.

The average number of staff movements for full-time equivalent permanent persons employed during the year was as follows:

2022-23

Joiners 0

Leavers 0

Transfers In from Other Government Bodies 1.0

Transfers Out to Other Government Bodies 0

Agency Staff 0.58

Net Movement 1.58

This equates to a staff turnover rate of 0%

Managing Attendance

The Parades Commission is comprised of seconded civil servants and manages attendance in line with the policies of secondees’ parent departments. Staff absence arising as a result of illness, including injuries, disability or other health problems, was approximately 1 day per employee in 2022-23 (2021-2022:1 day).

Disabled Employees

The Parades Commission aims to ensure that there is no discrimination on the grounds of disability and that access to employment and career advancement in the Commission is based solely on ability, qualifications and suitability for the post. The Commission complies with all existing legislation in regard to its disabled employees.

Equal Opportunities

In keeping with the NIO Equal Opportunities Policy Statement, everyone in the Parades Commission has the right of opportunity and to a good and harmonious working environment and atmosphere in which all staff are encouraged to apply their diverse talents and in which no member of staff feels under threat or intimidation.

Employee Involvement

The Commission does not directly employ staff, all staff are on secondment and the Commission does not contribute to the Civil Service People Survey, however the Commission acknowledges that the maintenance of a highly skilled workforce is key to the future of the business. The Parades Commission is committed to and complies with the policies of equal opportunity and responsibility for employee and career development of all staff.

The Parades Commission recognises the benefits of keeping employees informed of the progress of the business and of involving them in the Commissions performance. During the year the employees were regularly provided with information regarding the financial and economic factors affecting the performance of the Commission and on other matters of concern to them, as employees, through notices and regular staff meetings. All members of the secretariat are required to complete training through the Civil Service Learning platform on areas such as fraud, managing information and inclusion.

As the Commission does not directly employ the Secretariat, policies in relation to pay and benefits are set by the home organisations.

Health & Safety

The Parades Commission recognises its legal responsibilities in relation to the health and safety of its staff and is committed to operating an effective health and safety regime. In line with this commitment the Commission has complied with the relevant legislation.

Expenditure on Consultancy

There was no expenditure on consultancy in 2022-23 (2021-22: £nil).

Off-payroll engagements

There were no off-payroll engagements in 2022-23 (2021-22: £nil).

Exit packages (Audited)

There were no exit packages in 2022-23 (2021-22: £nil).

STATEMENT OF ACCOUNTING OFFICER’S RESPONSIBILITIES

Under paragraph 12(1) and para (2) of Schedule 1 to the Public Processions (Northern Ireland) Act 1998, the Secretary of State (with the consent of HM Treasury and Northern Ireland Office) has directed the Parades Commission for Northern Ireland to prepare for each financial year, a statement of accounts in the form and on the basis set out in the Accounts Direction. The accounts are prepared on an accruals basis and must give a true and fair view of the state of affairs of the Parades Commission for Northern Ireland and of its comprehensive net expenditure, statement of financial position, changes in taxpayers’ equity and cash flows for the financial year.

In preparing the accounts, the Accounting Officer is required to comply with the requirements of the Government Financial Reporting Manual and in particular to:

-

observe the Accounts Direction issued by the Northern Ireland Office on behalf of the Secretary of State, including the relevant accounting and disclosure requirements, and apply suitable accounting policies on a consistent basis;

-

make judgements and estimates on a reasonable basis;

-

state whether applicable accounting standards as set out in the Government Financial Reporting Manual have been followed, and disclose and explain any material departures in the financial statements;

-

prepare the financial statements on a going concern basis; and

-

confirm that the annual report and accounts as a whole is fair, balanced and understandable and take personal responsibility for the annual report and accounts and the judgments required for determining that it is fair, balanced and understandable.

The Accounting Officer of the Northern Ireland Office has designated the Secretary as the Accounting Officer for the Parades Commission for Northern Ireland. The responsibilities of an Accounting Officer, including responsibility for the propriety and regularity of the public finances for which the Accounting Officer is answerable, for keeping proper records and for safeguarding the Parades Commission for Northern Ireland’s assets, are set out in Managing Public Money published by the HM Treasury.

As the Accounting Officer, I have taken all the steps that I ought to have taken to make myself aware of any relevant audit information and to establish that the Parades Commission for Northern Ireland’s auditors are aware of that information. So far as I am aware, there is no relevant audit information of which the auditors are unaware. I confirm that the Annual report and Accounts as a whole is fair, balanced and understandable. I take personal responsibility for the Annual Report and Accounts and the judgements required for determining that it is fair, balanced and understandable.

GOVERNANCE STATEMENT

Introduction and Context

The Parades Commission for Northern Ireland (the Commission) is an independent executive non-departmental public body sponsored by the Northern Ireland Office (NIO) which was created on 27 March 1997. It was given statutory responsibilities on 16 February 1998 by the commencement of the Public Processions (Northern Ireland) Act 1998.

As at 31 March 2023 the Commission had six Commissioners, including its Chair. It is supported by a secretariat. The secretariat had on average six seconded staff, including myself, all seconded to the Commission from public sector bodies together with 0.58 Agency staff. I was appointed to the position of Secretary 1st July 2020.

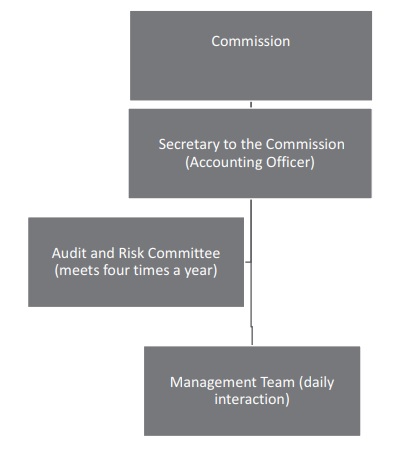

The Commission normally meets on a weekly basis and has a collective responsibility for approving any significant changes relating to the operation or use of resources of the Parades Commission. The Commission also has an Audit and Risk Committee which meets formally four times a year, or more frequently as required, to assist and advise the Accounting Officer on governance responsibilities. Any recommendations made by the Audit and Risk Committee must be approved by the Commission.

As Accounting Officer, I regularly discuss operational performance and corporate issues with the sponsor group within the NIO.

Scope of Responsibility

As Accounting Officer, I have responsibility for maintaining a sound system of internal governance that supports the achievement of the Commission’s policies, aims and objectives, whilst safeguarding the public funds and assets for which I am personally responsible, in accordance with the responsibilities assigned to me in Managing Public Money. As such, I am responsible for ensuring propriety and regularity in the handling of those public funds; and for the day-to-day operations and management of the Commission.

I am also responsible for the effective operation of the secretariat and for managing its financial and human resources. I provide advice and support to the Chair and Commissioners in support of their aims and objectives and in undertaking their statutory responsibilities. One of the statutory responsibilities of the Commission is “to keep under review, and make such recommendations as it thinks fit to the Secretary of State, concerning, the operation of the Act”. There were no recommendations made to the Secretary of State for Northern Ireland in 2022-23. There were no Ministerial directions in the 2022-23 financial year.

Governance Framework

In my role as Accounting Officer, I discharge my responsibilities with the support of the Audit and Risk Committee and my Management Team. This is outlined below:

Commission’s Performance

The statutory duties of the Commission include:

-

promoting greater understanding by the general public of issues concerning public processions;

-

promoting and facilitating mediation as a means of resolving disputes concerning public processions;

-

keeping itself generally informed as to the conduct of public processions and protest meetings; and

-

keeping under review, and making such recommendations as it thinks fit to the Secretary of State concerning, the operation of the Act.

Throughout 2022-23 the Commission effectively discharged its statutory functions and duties. It received representation and where necessary, issued determinations on parades and parade related protests. In line with best practice, the operational procedures of the Commission and the quality of data used by the Commission is kept under continuous review to ensure that the Commission is content that it is provided with all requisite information to enable it to make informed decisions.

Attendance at Commission meetings during 2022-23 is set out in the following table:

|

Commissioners

|

Commission Meeting Attendance/Eligible to attend

|

|

Graham Forbes (Chair)

|

28/28

|

|

Joelle Black

|

25/28

|

|

Marian Cree

|

27/28

|

|

Billy Gamble

|

28/28

|

|

Eimear McAllister

|

28/28

|

|

Derek Wilson

|

27/28

|

All meetings were quorate.

Strategic objectives were agreed to reflect the Commission’s statutory duties and functions, incorporating its strategic vision. The Commission uses these objectives as a basis for the 2022-23 Business Plan. The 2022-23 Business Plan can be found on the website.

Audit and Risk Committee

The Audit and Risk Committee supports the Accounting Officer and the Commission in their responsibilities for the management of risk and the effectiveness of the internal system of control and governance arrangements. The Committee fulfils this responsibility by reviewing whether proportionate assurances for meeting the Commission’s and Accounting Officer’s responsibilities are available and by testing the reliability and integrity of these assurances. This includes oversight of the effective operation and impact of the Framework Document and the Commission’s business planning process.

The Audit and Risk Committee is comprised of five Commissioners, and must have two Commissioners in attendance to be quorate. The Committee is also attended by the Accounting Officer, Deputy Secretary, Internal Audit, the National Audit Office (as external auditors), external accountant and representatives from the sponsor department. The Committee meets four times per year and more frequently as required. In addition to providing all Commissioners with a copy of the minutes of meetings of the Committee, the Chair of the Audit and Risk Committee briefs the Commission after each meeting.

Attendance at the Audit and Risk Committee is disclosed in table below:

|

Membership in 2022/23

|

No. of Meetings attended/ Eligible to attend

|

|

Joelle Black

|

4/4

|

|

Marian Cree

|

4/4

|

|

Eimear McAllister

|

4/4

|

|

Derek Wilson

|

3/4

|

|

Billy Gamble

|

4/4

|

All meetings were quorate.

During the 2022-23 financial year, the Audit and Risk Committee advised the Commission on the following significant areas:

-

The accounting policies, the accounts and the annual report of the organisation, including the process for review of the accounts prior to submission for audit, level of errors identified and management’s letter of representation to the external auditors;

-

The risk management process;

-

The planned activity and results of both internal and external audit;

-

The adequacy of management responses to issues identified by audit activity, including the external auditor’s Audit Completion Report and the progress on the implementation of recommendations from internal and external audit reports; and

-

Specific, significant issues for the attention of the Committee.

Based on the views expressed by the Accounting Officer, the Internal Auditors and the External Auditors, the Committee was satisfied with its overall effectiveness.

Corporate Governance

The Commission conducts its affairs in accordance with a comprehensive corporate governance framework. Although not part of central government, the Commission abides by the spirit and principles set out in the Corporate Governance Code (Corporate governance in central government departments, code of good practice, published by HM Treasury and the Cabinet Office, April 2017) as far as applicable. There are elements of the Code which are either not applicable to the Commission e.g. the composition of the board, or which are disproportionate due to the size and remit of the organisation and good governance can be achieved by other more proportionate means. The Commission has a comprehensive Framework Document agreed with the NIO which sets down its values and principles, roles and responsibilities and clear lines of accountability.

As Accounting Officer, I have responsibility for reviewing the effectiveness of the control environment and I am satisfied that the Commission has the necessary policies and controls in place to ensure good governance and meet the Code of Practice as far as applicable. This review is informed by the work of staff who have the responsibility for the development and maintenance of the control framework, by the work of internal audit and by the findings of the external auditors in their report to those charged with governance and any other reports. I also complete Stewardship Statements bi-annually. These statements help to identify areas of improvement and provide assurances to the NIO’s Principal Accounting Officer on the effectiveness of management controls. The statements also inform the content of this Governance Statement.

The Commission has a raising concerns (whistleblowing) policy in place to ensure that staff who raise concerns receive a response and are informed about how their concerns are being dealt with. The handling of complaints is set out in the Commission’s Complaints Procedure.

Internal Audit Reports Submitted to Audit and Risk Committee

In 2022-23 ASM were internal auditors to the Parades Commission, appointed through a tender competition. The services provided by ASM operate to standards defined by the Public Sector Internal Audit Standards.

Internal Audit’s work plan is informed by an analysis of the risk to which the Commission is exposed and the plan is considered by the Audit and Risk Committee before it is agreed by the Commission.

Internal Audit’s findings are presented to the Audit and Risk Committee and copies of all final reports are sent to me, as Accounting Officer. In addition, Internal Audit provides an annual written statement to the Audit and Risk Committee, setting out a formal opinion on the adequacy and effectiveness of the Committee’s risk management, control and governance processes. Internal Audit conducted three reviews on the following activities during 2022-23:

-

Review of Procurement and Contract Management;

-

Review of information Management including Compliance with GDPR, and

-

Follow-up review from 2021-22.

All of the above reports received ‘Satisfactory’ opinion ratings. There were four Priority 3 recommendations made, these are low level recommendations which could lead to an increased risk exposure. All of these recommendations have been accepted by management and will be implemented during 2023-24.

In the Annual Assurance Statement, the Internal Auditors stated that, during the year ended 31 March 2023, the Commission’s systems in relation to risk management, control and governance were adequate and operated effectively, thereby providing an overall ‘Satisfactory’ assurance in relation to the effective and efficient achievement of the Commission’s objectives.

Risk Assessment

The Commission’s corporate governance controls are designed to manage risk to a reasonable level rather than to eliminate all risk of failure to achieve policies, aims and objectives; it can therefore only provide reasonable and not absolute assurance of effectiveness. Risks are managed on an ongoing basis in a process that is designed to identify and prioritise the risks to the achievement of the Commission’s policies, aims and objectives; to evaluate the likelihood of those risks being realised and the impact should they be realised; and to manage them efficiently, effectively and economically. The system of internal control was in place for the year ended 31 March 2023 and up to the date of approval of the annual report and accounts, and accords with HM Treasury guidance.

The system is based on a framework of regular management information, administrative procedures, including the segregation of duties, and a system of delegation and accountability. In particular it includes:

-

Comprehensive budgeting systems with an annual budget which is reviewed and agreed by the Secretary to the Commission;

-

Regular reviews of periodic and annual financial reports which indicate financial performance; and

-

As appropriate, formal project management disciplines.

Throughout the year the Commission had a risk register in place that has been assessed and considered at management level. The register has been scrutinised, discussed at both the Audit and Risk Committee and Commission meetings.

The Commission operates a “traffic light” corporate risk register in line with Government guidance. The Commission revised its corporate risk register following feedback received from the internal auditors. Changes have been made to the format of the register and each risk has been assigned a risk owner. The register is kept under constant review, with a formal quarterly review, and update by management as necessary. Risks are identified and assessed in terms of likelihood of occurrence and impact of risk. Management considers signs of risks changing, examines existing risk control tools and, if necessary, takes remedial action.

The Commission’s risks are identified by the Commissioners, by me as Accounting Officer and by my management team and they are ratified by the Audit and Risk Committee and the Commission. The risks have been ranked according to ‘Likelihood’ and ‘Impact’. We have also assessed what actions are in place, or need to be taken, to mitigate the organisational risks identified.

During the course of 2022-23 our main risks were financial and reputational risks, including procedures not being followed, protection of our information including risk from cyber attack and loss of knowledge due to staff turnover, as a result of a number of key Secretariat staff contracts coming to an end. This risk has been mitigated with extensions to secondment agreements agreed for all relevant staff. One new risk which emerged, and will continue into 2023-24, relates to the contract with our website and notification management system coming to an end and the intended new supplier advising they were no longer able to provide the service. The Commission has undertaken mitigating actions and the Commission will continue to have a website and notification management system which are fit for purpose.

On-going operational risks are managed as follows:

-

all operational risks are identified, captured, evaluated and controlled by me and my management team and communicated to the Audit and Risk Committee;

-

Any changes to the assessment and evaluation of risk are noted by the Audit and Risk Committee and ratified by the full Commission; and

-

The full Commission has a responsibility to lead on determining and evaluating the Commission’s risks; and

-

Risks are communicated to staff by management, via regular staff meetings and in the risk register.

Personal Data Related Incidents

There were no personal data related incidents formally reported to the Information Commissioner’s Office.

Significant Internal Control Issues

There were no significant internal control issues identified during 2022-23.

Events after the Reporting Period

There are no events to note.

S Teer

Secretary and

Accounting Officer 26 June 2023

Parliamentary Accountability and Audit Report

The accounts of the Parades Commission for Northern Ireland are audited by the Comptroller and Auditor General under the Public Processions (Northern Ireland) Act 1998. The audit fee charged was £20,875 (£16,500 in 2021-22). The auditors received no fees for non-audit services.

All expenditure was applied to the purpose intended by Parliament (audited).

No fees or charges were collected by the Parades Commission for Northern Ireland (audited).

The Parades Commission for Northern Ireland has no remote contingent liabilities (audited) (2021-22:nil)

The Parades Commission for Northern Ireland had no losses or special payments (audited) (2021-22:nil)

The Commission has given due consideration to the UK Functional Standards in all aspects of its work embedding these into its Corporate Plan and ways of working as appropriate. The Commission will continue to assess its compliance with these standards and make improvements as necessary.

The Parades Commission for Northern Ireland’s net expenditure in 2022-23 was £722,298. The total comprehensive expenditure for prior years was as follows:

Expenditure and income

|

|

2022-23

£

|

2021-22

£

|

|

Net Expenditure

|

722,298

|

675,653

|

|

Other Comprehensive Expenditure

|

-

|

23

|

|

Total Comprehensive Expenditure

|

722,298

|

675,676

|

S Teer

Secretary and

Accounting Officer 26 June 2023

THE CERTIFICATE AND REPORT OF THE COMPTROLLER AND AUDITOR GENERAL TO THE HOUSES OF PARLIAMENT

Opinion on financial statements

I certify that I have audited the financial statements of the Parades Commission for Northern Ireland for the year ended 31 March 2023 under the Public Processions (Northern Ireland) Act 1998.

The financial statements comprise the Parades Commission for Northern Ireland’s:

-

Statement of Financial Position as at 31 March 2023;

-

Statement of Comprehensive Net Expenditure, Statement of Cash Flows and Statement of Changes in Taxpayers’ Equity for the year then ended; and

-

the related notes including the significant accounting policies.

The financial reporting framework that has been applied in the preparation of the financial statements is applicable law and UK adopted international accounting standards.

In my opinion, the financial statements:

-

give a true and fair view of the state of the Parades Commission for Northern Ireland’s affairs as at 31 March 2023 and its net expenditure for the year then ended; and

-

have been properly prepared in accordance with the Public Processions (Northern Ireland) Act 1998 and Secretary of State directions issued thereunder.

Opinion on regularity

In my opinion, in all material respects, the income and expenditure recorded in the financial statements have been applied to the purposes intended by Parliament and the financial transactions recorded in the financial statements conform to the authorities which govern them.

Basis for opinions

I conducted my audit in accordance with International Standards on Auditing (UK) (ISAs UK), applicable law and Practice Note 10 Audit of Financial Statements and Regularity of Public Sector Bodies in the United Kingdom (2022). My responsibilities under those standards are further described in the Auditor’s responsibilities for the audit of the financial statements section of my certificate.

Those standards require me and my staff to comply with the Financial Reporting Council’s Revised Ethical Standard 2019. I am independent of the Parades Commission for Northern Ireland in accordance with the ethical requirements that are relevant to my audit of the financial statements in the UK. My staff and I have fulfilled our other ethical responsibilities in accordance with these requirements.

I believe that the audit evidence I have obtained is sufficient and appropriate to provide a basis for my opinion.

Conclusions relating to going concern

In auditing the financial statements, I have concluded that the Parades Commission for Northern Ireland’s use of the going concern basis of accounting in the preparation of the financial statements is appropriate.

Based on the work I have performed, I have not identified any material uncertainties relating to events or conditions that, individually or collectively, may cast significant doubt on the Parades Commission for Northern Ireland’s ability to continue as a going concern for a period of at least twelve months from when the financial statements are authorised for issue.

My responsibilities and the responsibilities of the Accounting Officer with respect to going concern are described in the relevant sections of this certificate.

The going concern basis of accounting for the Parades Commission for Northern Ireland is adopted in consideration of the requirements set out in HM Treasury’s Government Financial Reporting Manual, which require entities to adopt the going concern basis of accounting in the preparation of the financial statements where it is anticipated that the services which they provide will continue into the future.

Other Information

The other information comprises the information included in the Annual Report, but does not include the financial statements nor my auditor’s certificate and report. The Accounting Officer is responsible for the other information.

My opinion on the financial statements does not cover the other information and, except to the extent otherwise explicitly stated in my certificate, I do not express any form of assurance conclusion thereon.

My responsibility is to read the other information and, in doing so, consider whether the other information is materially inconsistent with the financial statements, or my knowledge obtained in the audit, or otherwise appears to be materially misstated.

If I identify such material inconsistencies or apparent material misstatements, I am required to determine whether this gives rise to a material misstatement in the financial statements themselves. If, based on the work I have performed, I conclude that there is a material misstatement of this other information, I am required to report that fact.

I have nothing to report in this regard.

Opinion on other matters

In my opinion the parts of the Remuneration and Staff Report to be audited have been properly prepared in accordance with Secretary of State directions issued under the PublicnProcessions (Northern Ireland) Act 1998.

In my opinion, based on the work undertaken in the course of the audit:

-

the parts of the Accountability Report subject to audit have been properly prepared in accordance with Secretary of State directions made under the Public Processions (Northern Ireland) Act 1998; and

-

the information given in the Performance and Accountability Reports for the financial year for which the financial statements are prepared is consistent with the financial statements and is in accordance with the applicable legal requirements.

Matters on which I report by exception

In the light of the knowledge and understanding of the Parades Commission for Northern Ireland and its environment obtained in the course of the audit, I have not identified material misstatements in the Performance and Accountability Reports.

I have nothing to report in respect of the following matters which I report to you if, in my opinion:

-

Adequate accounting records have not been kept by the Parades Commission for Northern Ireland or returns adequate for my audit have not been received from branches not visited by my staff; or

-

I have not received all of the information and explanations I require for my audit; or

-

the financial statements and the parts of the Accountability Report subject to audit are not in agreement with the accounting records and returns; or

-

certain disclosures of remuneration specified by HM Treasury’s Government Financial Reporting Manual have not been made or the parts of the Remuneration and Staff Report to be audited are not in agreement with the accounting records and returns; or

-

the Governance Statement does not reflect compliance with HM Treasury’s guidance.

Responsibilities of the Accounting Officer for the financial statements

As explained more fully in the Statement of Accounting Officer’s Responsibilities, the Accounting Officer is responsible for:

-

maintaining proper accounting records;

-

providing the C&AG with access to all information of which management is aware that is relevant to the preparation of the financial statements such as records, documentation and other matters;

-

providing the C&AG with additional information and explanations needed for his audit;

-